Waterhouse VC is a fund that specialises in global publicly listed and private businesses related to wagering and gaming sectors. The fund is only available to wholesale investors.

Since inception in August 2019, Waterhouse VC has achieved a gross total return of +3,880% (annualised at 81%), as at 31 October 2025, assuming the reinvestment of all distributions.

Play Your Hand

No one rushes to the pub to talk about their fixed-income fund returning 5%. But buying Bitcoin at $300? That’s a story that gets retold. Same Game Parlays (SGPs) work on the same principle in sports betting: small bets with big payout potential that bettors chase and share with their friends.

An SGP, also called a Same Game Multi or Bet Builder, lets bettors combine multiple outcomes within a single match. Instead of just betting on Barcelona to win, a punter can add: over 8 corners, a specific player to score, and both teams to get a card - all in one bet with compounding odds. The format turns every bet into a potential payday story.

The appeal is obvious. Recreational bettors aren't always satisfied with a $20 profit on a straight match bet. They want the $10-into-$500 story. SGPs deliver that lottery-style format.

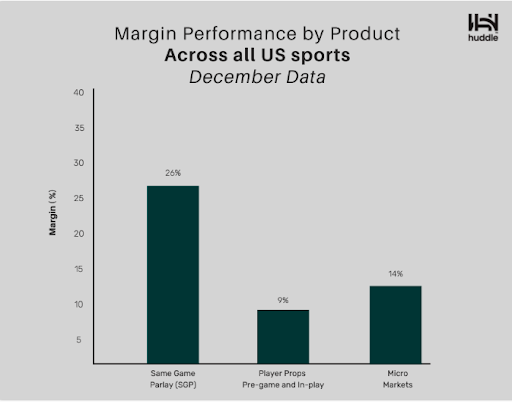

For operators, SGPs solve a critical problem. Rising costs - licenses, taxes, compliance, data fees - squeeze margins on traditional betting. Head-to-head bets return 4-6% on turnover; SGPs consistently deliver high-teen margins, often exceeding 20%.

This margin expansion isn't luck. Because SGP outcomes are correlated (if Barcelona wins, they're more likely to have had shots on target), pricing becomes complex. Punters can't benchmark value across operators, and the house edge compounds with each added leg. The huge appeal to bettors and structural margin advantage have made SGPs the most important product innovation in modern sports betting.

The Margin Multiplier

In the U.S., parlays have grown to more than a quarter of total handle and more than half of revenue. For Flutter, SGPs accounted for 19.2% of stakes in 2019, rising to 24.3% in 2023, with margins on these bets increasing from 13.1% to 18.5% as bettors added more legs. In 2023, 262 million SGPs were placed across its brands, up 75% year-over-year (Source: Flutter).

Margin performance by product across all US sports. Source: Huddle

Entain reports that in Spain, about 20% of football bets are now bet builders, while in Brazil the figure approaches 40%. Overall bet builder stakes more than doubled in 2024 and their share doubled again in the first half of 2025. DraftKings’ path to profitability has been driven largely by mix-shift towards parlays and SGPs.

Illustrative margin impact on $1 billion handle (assuming 5% single hold, 25% SGP hold)

How We Got Here

Given their impact, it is striking how recent SGP growth has been. When bookmakers first transitioned online in the 2000s, priorities centred on replicating retail. It was functional and familiar, with no major incentive to build differently.

Bet365 website interface in 2004. Source: whatdiditlooklike

The 2010s shifted focus to mobile and in-play. Apps, streaming, cash out and fast data feeds absorbed investment, while regulators pressed compliance hurdles and costs onto operators.

In-play looked like the natural growth engine. It delivered higher hold than straight pre-match 1X2, and made it harder for customers to benchmark fair prices in real time, producing margins in the 8-12% range. Retail shop windows had long advertised high-margin combinations like “Team A to win to nil and Player X to score”, prefiguring the modern SGP, but there was no infrastructure to price correlated legs dynamically.

Request A Bet

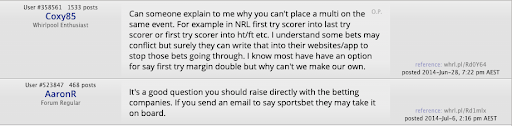

The first signal of changing preferences came from Twitter (now X). Sky Bet noticed customers asking for prices on markets that didn’t exist, turned the feed into ‘Request A Bet’, and put traders on it full-time, with other competitors soon following suit. Manually pricing thousands of requests was not scalable, so operators pre-packaged popular combos, but the demand was for self-service.

Coxy85’s forum question that sparked SGP development: why same-game multis weren’t possible. Source: Whirlpool

Coxy85’s question reached John Maguire at Sportsbet, then Paddy Power’s emerging Australian brand. Maguire’s team used correlation models developed by Paddy Power and launched SGPs for the 2016 AFL Grand Final. A $50,000 win from two $20 bets showed the pull of long-odds, small-stake builders. Flutter rolled the product across Europe, and what began as manual Twitter quotes became a systematised, high-margin core product.

Engineering Problem

The complexity of what Flutter and a few other operators and suppliers have built is easy to underestimate - and that complexity is the moat. When FanDuel launched SGP in the U.S. in 2019, the core engine had been hardened in European football. By month five, SGPs were 5% of online sports betting wagered. DraftKings took two years to release their own version.

Today, the majority of SGP legs are player props. A typical ticket is no longer 'player to score, team to win and over 2.5 goals'. It is: ‘team to win, over 2.5 goals, striker to score, defender 2+ fouls, winger 3+ shots, midfielder to be carded and 10+ corners’. Every leg pulls on the others. If the winger shoots more, the striker is more likely to score, the team is more likely to win and the game is more likely to go over.

To handle that, you need a single model that sees the whole match. Historical data has to be ingested and refreshed. Live feeds have to be mapped in real time. On top sits a projection layer that simulates how the game will play out and produces prices for every market. The SGP layer then takes the customer's selections and asks that engine for the combined probability, instantly, every time a leg is added or removed.

Product Market Fit

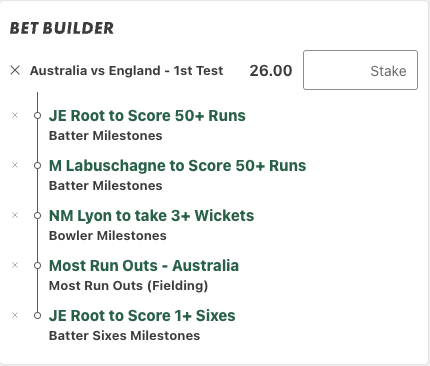

SGPs succeed because every event becomes an opportunity to express a view. Few understand implied probabilities, but they hold opinions about the players and their attributes, and those opinions - not mathematical expectation - drive behaviour. When it comes to Ashes cricket, they talk about Root and Labuschagne’s recent form, Bazball aggression, and Lyon on a deteriorating pitch.

SGP slip that pays 26.0 for the 1st Ashes Test. Source: Bet365

As legs tick off, there is the same satisfaction as working through a checklist. When one leg loses, it feels like a near miss rather than a clean loss which is a powerful retention mechanic. DraftKings have even introduced a GhostLeg feature that still pays out if one leg loses.

On a seven-leg builder at 18.0, benchmarking value is tough. The true price might be 30.0, but few will rebuild across operators to check. The margin builds as small pricing errors compound and customers pay a convenience premium for doing everything in one app.

For most recreational bettors, correctly “calling the game” is more satisfying than being validated on price. FanDuel reports that around 90 percent of its SGP tickets are 30 dollars or less, with roughly 60 percent at 5 dollars or less (Source: WSJ). This small-stake structure is suited to restrictive markets like the UK, where financial vulnerability concerns have constrained high-limit bookmaking. In Australia, where there is no online casino, or in-play online, operators need high-margin formats to avoid margin compression.

The Risks for Operators

The format's popularity creates new risks operators are still learning to manage. Most SGP action is recreational - punters aren't thinking about correlation pricing. That makes them interesting for sharps, who can disguise themselves in the flow. Books are happier to take SGP action than straight bets, and thinking laterally can surface angles.

AK Bets highlighted one example: goalkeeper cards in specific game states. If a heavy favourite was trailing late, the opposing goalkeeper was often priced at 200/1 to be booked in the last 10 minutes - prime time-wasting territory. The model priced 200/1 across all game states rather than differentiating for specific situations.

Popularity also creates concentration risk. Gambling influencers regularly post their picks to large followings. Thousands of individuals backing the same 100/1+ combinations could eventually land and expose a small operator to significant liability - particularly when the correlated outcomes all hit at once.

The Opportunity

For Waterhouse VC, SGPs are a case study in how regulation, consumer behaviour and innovation can align. The same forces will shape the next wave of products that let fans go deeper into the sports they care about, while giving operators defensible margins in heavily regulated markets.

Data is the starting point for any modern betting product - from pricing correlation in SGPs to creating entirely new markets and experiences. That is one of the reasons why we believe a business like Racing and Sports is particularly exciting. Those who own the data, can build the best pricing engines, and control the product layer that will set the terms for everyone else.

SGPs are also a product that sportsbooks currently will offer better than any prediction market. Every contract requires full cash backing upfront, limiting the breadth of combinations they can offer compared with a sportsbook’s risk model. In the near term, product depth and differentiation will remain with the books.

Pitch Us

If you know any gambling tech companies seeking capital or distribution support, our new 'Pitch' page makes it simple to connect with our investment team.

Media

Tom spoke on Ausbiz about the latest developments in prediction markets and Racing and Sports’ new commercial agreement with LeoVegas Group to take over the delivery of the racing service for all its brands in the UK.

For wholesale investors interested in following wagering and gaming industry news and trends, please follow our updates on Twitter (@waterhousevc) and WaterhouseVC.com.

DISCLAIMER AND IMPORTANT NOTES

Please note the above information in relation to Flutter Entertainment, Huddle, Entain, DraftKings, Bet365, Sky Bet, X (formerly Twitter), Whirlpool, Sportsbet, Paddy Power, FanDuel, Wall Street Journal, AKBets, and Racing and Sports is based on publicly available information and should not be considered nor construed as financial product advice. The Fund currently has a position in RAS Technology Holdings and Flutter Entertainment Plc. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

Not for Release or Distribution in the United States of America

This material may not be released or distributed in the United States. This material does not constitute an offer to sell, or a solicitation of an offer to buy, any securities in the United States or any other jurisdiction in which such an offer would be illegal. The units in the Fund have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the U.S. Securities Act) or the securities laws of any state or other jurisdiction of the United States. Accordingly, the units in the Fund may not be offered or sold in the United States unless they are offered and sold, directly or indirectly, in transactions exempt from, or not subject to, the registration requirements of the U.S. Securities Act and any other applicable United States state securities laws.

General Information Only

This material is for general information only and is not an offer for the purchase or sale of any financial product or service. The material has been prepared for investors who qualify as wholesale clients under sections 761G of the Corporations Act or to any other person who is not required to be given a regulated disclosure document under the Corporations Act. The material is not intended to provide you with financial or tax advice and does not take into account your objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by Sandford Capital, Waterhouse VC or any other person. To the maximum extent possible, Sandford Capital, Waterhouse VC or any other person do not accept any liability for any statement in this material.

Financial Regulatory Oversight and Administration

Waterhouse VC is an Australian Unit Trust denominated in AUD and available to wholesale institutional investors worldwide with a minimum of AUD 500,000 or USD / EUR / GBP / JPY / CHF equivalent. This material has been prepared by Waterhouse VC Pty Ltd (ABN 48 635 494 861) (‘Waterhouse VC’, ‘Trustee’, ‘us’ or ‘we’) as the Trustee of the Waterhouse VC Fund (the ‘Fund’). The Trustee is a corporate authorised representative (CAR 1278656) of Sandford Capital Pty Limited (ABN 82 600 590 887) (AFSL 461981) (Sandford Capital) and appoints Sandford Capital as its AFS licensed intermediary under s911A(2)(b) of the Corporations Act 2001 (Cth) to arrange for the offer to issue, vary or dispose of units in the Fund.

Performance

Past performance of Waterhouse VC is not a reliable indicator of future performance. We make every endeavour to ensure results are accurate. Waterhouse VC Pty Ltd does not guarantee the performance of any strategy or the return of an investor’s capital or any specific rate of return. No allowance has been made for taxation, where applicable. We encourage you to think of investing as a long-term pursuit. Waterhouse VC’s results are indicative only and subject to subsequent year end external financial review.

Copyright

Copyright © Waterhouse VC Pty Ltd ACN 635 494 861. No part of this message, or its content, may be reproduced in any form without the prior consent of Waterhouse VC.

Governing Law

These Terms and Conditions of use are governed by and are to be construed in accordance with the laws of New South Wales. By accepting these Terms and Conditions of use, you agree to the non-exclusive jurisdiction of the courts of New South Wales, Australia in respect of any proceedings concerning these Terms and Conditions of use.