Welcome to the May 2021 newsletter for the Waterhouse VC Fund.

The Fund specialises in gambling assets and businesses that are related to the gambling industry. The industry is under-researched by most mainstream fund managers. We aim to leverage our unique expertise and existing assets to generate capital growth for investors over the long-term.

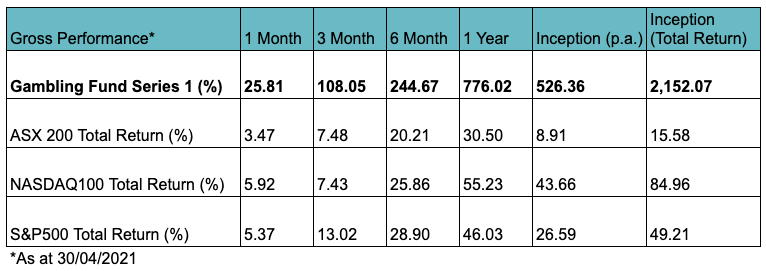

Since inception in August 2019, the Waterhouse VC Fund has achieved a total return of 2,152% (assuming the reinvestment of all distributions). The unit price is $22.51, as at 30 April 2021. See our long-term performance table at the end of this newsletter.

Filling the funnel

Despite the gambling industry being excluded from many portfolio mandates due to ESG concerns, it is a sector that is still widely covered by investment analysts. And with the legalisation of online gambling spreading across the US, the sector is receiving more attention than ever.

As long-term operators in the gambling industry, we can source investment ideas and insights that other investors simply can’t. Some of our most successful investments to date have originated from first-hand experience, vendor relationships or unique access, such as Playtech and BetMakers. We are also able to invest in smaller companies like Aspire Global without compromising portfolio liquidity.

The recent addition of XLMedia to the portfolio is a product of our domain expertise and ability to invest in smaller companies. XLMedia is an online gambling affiliate marketing company, acting as an outsourced customer acquisition channel. Similar to Tripadvisor’s offering to travel operators, XLMedia’s primary purpose is to attract and engage a fragmented customer base of punters and connect them to the products and services of gambling operators.

The company achieves this by building and maintaining a portfolio of approximately 2,000 websites, with a range of content strategies that includes sports news, betting education, casino promotions and odds comparison.

XLMedia initially served the online gambling markets in Europe, particularly Finland, where there are many online casinos competing for attention. The barriers to entry in these mature online casino markets are low, and the offerings are largely undifferentiated because the functionality is outsourced to a handful of providers. The expertise of affiliates is in competing for the highest organic rankings in the Google Search results, which attract the lion’s share of the traffic, and then funneling customers to the casino websites in return for fees. XLMedia has diversified considerably since the early days, by geography and end market, focusing on a number of sub-verticals within online gambling as well as financial services.

XLMedia’s FY20 target verticals mix by revenue. Image: XLMedia 2020 Full Year Results

There are two main revenue models in the affiliate industry: revenue share and CPA. Under a revenue share arrangement, the affiliate receives a long-term trailing commission that is a percentage of the gross gambling losses of the referred customer. The CPA model is just a one-time payment per customer, no matter how much they spend or lose. CPA payments tend to be higher than revenue share in the short-term, and can be attractive when the affiliate can send a punter to multiple operators and earn multiple fees.

The affiliate channel is particularly attractive because you only pay on success. Other channels like mass media or the major digital platforms generally offer a CPM (cost per thousand impressions) or PPC (pay per click) model, where the advertiser has to pay to access an audience yet still takes on the risk of converting the prospect on their website. Generally, a customer acquired through an affiliate is recognised only when they’ve made a deposit, more closely aligning incentives and making it a low-risk investment for operators. 77% of XLMedia’s revenue is purely performance-based. With 17% of conversions generating 57% of revenues, it demonstrates XLMedia’s ability to attract the high-spending VIP clients that are most valuable to gambling operators.

XLMedia’s FY20 revenue and conversion mix. Image: XLMedia 2020 Full Year Results

Searching for growth

XLMedia previously had a much larger portfolio, taking a more programmatic approach to content across a portfolio of about 3,500 websites. Those familiar with how Google continually improves its Search algorithm would be aware that this approach is risky, as the algorithm is always being improved to ensure those gaming the system are placed below genuine content in the Search results.

In January 2020, over 100 of its casino websites were manually demoted by Google, impacting their online ranking and contributing to revenue falling 31% from US$79.5 million in 2019 to US$54.8 million in 2020. New management has focused on fewer websites with higher quality content and now just 60 premium websites generate 75% of XLMedia’s revenue.

To address revenue concentration in mature European markets, XLMedia also outlined further plans to make investments into growing markets, particularly the US.

XLMedia revenue by geography. Source: XLMedia 2020 Full Year Results

By 2022, almost 60% of the US population will have access to some form of legalised online betting. Acting on the opportunity, management has made two key acquisitions (in December 2020 and March 2021) that have created immediate scale in the US across marketing, content production, search optimisation and technology development.

In December 2020, XLMedia spent US$15.5 million (plus a potential future contingent consideration of up to US$9.5m, based on net revenue performance) to acquire CBWG, a digital media publishing group focused on professional and college sports news and betting. Key assets acquired include CrossingBroad.com, PASportsBooks.com, BetNewJersey.com, EliteSportsNY.com, PromoCodeKings.com and ActionRush.com. The business is registered as a sports gaming affiliate in six states, including New Jersey and Pennsylvania. CBWG has experienced 140% revenue outperformance in Jan and Feb 2021 compared to the revenue forecast outlined in the acquisition case.

Sports Betting Dime (SBD) was acquired for US$25.2 million in March 2021. We are particularly excited by the business’ diversified opportunity set. SBD operates a multi-channel platform to provide tools and a range of data for bettors, including betting odds, trends, trackers and analysis. Unlike most affiliate businesses, SBD enjoys high intention traffic due to its premium news and podcast content and tools that are relevant to more active punters.

SBD is successfully monetising their one million website visitors per month (similarweb) in nine states through XLMedia’s existing relationships. XLMedia can leverage its licences and existing relationships to drive revenue growth from each addition to the portfolio.

XL tailwinds

Affiliates are often characterized as a ‘necessary evil’ in many industries, as they can be an effective acquisition channel but at the cost of control. In our experience, they can be a critical channel for emerging operators.

While larger established operators can invest in dedicated teams for many separate marketing channels, startups and emerging operators running a tight ship need lower risk channels like affiliates to gain market share. Further, the nature of the channel means that operators only pay when the customer has become a depositor, which is preferable from a cash flow perspective too.

Operators in the US, big and small, are spending up to $1,000 per customer acquired in their pursuit of crucial US market share. These high CPAs are coupled with massive budgets. In the latest Q1 report from DraftKings, the company spent US$229 million on marketing on US$312 million of revenue. During the second half of 2020, Flutter’s US operations spent US$236 million on marketing on US$928 million in revenue. And that’s just the top two players. Since June 2020, the advertising spend of US sports gambling brands has increased by 82%. The current ‘land grab’ environment is the perfect market dynamic for XLMedia and the broader affiliate marketing industry.

XLMedia trades at an earnings multiple circa 4.7X forward EV/EBITDA. That’s around half the valuation multiple of listed peers. The business has net cash of US$12.3 million, with almost no long-term debt on the balance sheet.

XLMedia valuation compared to listed peers (as at 8 May, 2021)

The business could exceed near-term expectations through strong performance from CBWG and SBD, or from the potential recovery of the seven remaining penalised casino websites. Trading at less than five times forward EBITDA, we see tailwinds for organic growth and a management team that can turn its focus from the issues with Google to the US opportunity.

For wholesale investors that want to follow gaming’s global growth, please follow us for updates on Twitter @waterhousevc.

Please note the above information in relation to XLMedia, DraftKings and Flutter Entertainment is based on publicly available information in relation to each of them and should not be considered nor construed as financial product advice. The Fund currently has a position in XLMedia and Flutter Entertainment. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

Gambling Fund gross performance as at 30 April 2021