Welcome to the June 2021 newsletter for the Waterhouse VC Fund.

The Fund specialises in gambling assets and businesses that are related to the gambling industry. The industry is under-researched by most mainstream fund managers. We aim to leverage our unique expertise and existing assets to generate capital growth for investors over the long-term.

Since inception in August 2019, the Waterhouse VC Fund has achieved a total return of 1,876% (assuming the reinvestment of all distributions). The unit price is $19.75, as at 31 May 2021. See our long-term performance table at the end of this newsletter.

A portfolio sale and capital reallocation

During the month, the fund exited its position in Ubisoft, initially covered in our January 2020 newsletter. We are exploring multiple exciting opportunities, which we believe provide a greater return profile for our investors.

We were initially attracted to Ubisoft’s scale and hit franchises, including Assassin’s Creed, Tom Clancy and Far Cry. Scale is particularly important in game development because development costs are spread across a large customer base. We were confident that Ubisoft’s portfolio would drive loyalty, increased economies of scale and continued improvements in the quality of titles produced. At Waterhouse VC, we are particularly attracted by founder-led businesses, which have outperformed the broader market. The founding Guillemot brothers remain entrenched in the leadership of Ubisoft and retain an 18.5% equity stake in the US$8.9 billion dollar company. However, we have been disappointed by key issues concerning the employee count, lack of sports franchises and balance sheet. We prefer the titles, valuation and strategy of Take-Two Interactive.

Video gaming is constrained by players’ limited hours such that quality revenue generation is particularly challenging. We believe that game developers with scale and long-running franchise ecosystems are best positioned to extract the lion’s share of value through increases in revenue per player.

However, it is not as simple as cherry-picking the largest and most well-known developers, such as Take-Two (Grand Theft Auto, NBA 2K, Red Dead Redemption), Ubisoft and Activision Blizzard (Call of Duty, Crash Bandicoot, Candy Crush). The game development industry is far more challenging than most imagine. Poorly executed game releases destroy brand and shareholder value. For example, Cyberpunk 2077 was delayed three times by $US4.8 billion developer CD Projekt before delivering a terrible console experience. Despite other games in their arsenal, including The Witcher franchise, CD Projekt’s valuation declined over 60% following the release.

Disappointing Cyberpunk 2077 player experience. Image: pcmag

A team game

The coalescence of audio, gameplay, story-telling, design and technology needed to develop a game requires flawless execution by a qualified, driven and well-incentivised team. As highlighted in our December 2020 newsletter, Take-Two’s subsidiary studios earn 15-20% profit share on their respective productions. This incentive has helped to drive total net bookings by circa +17% CAGR since 2012. Net bookings is approximately current sales plus deferred orders (more specifically defined as the net amount of products and services sold during the period, including licensing fees, merchandise, in-game advertising, strategy guides and publisher incentives).

Take-Two’s net bookings progression. Image: March 2021 Investor Presentation

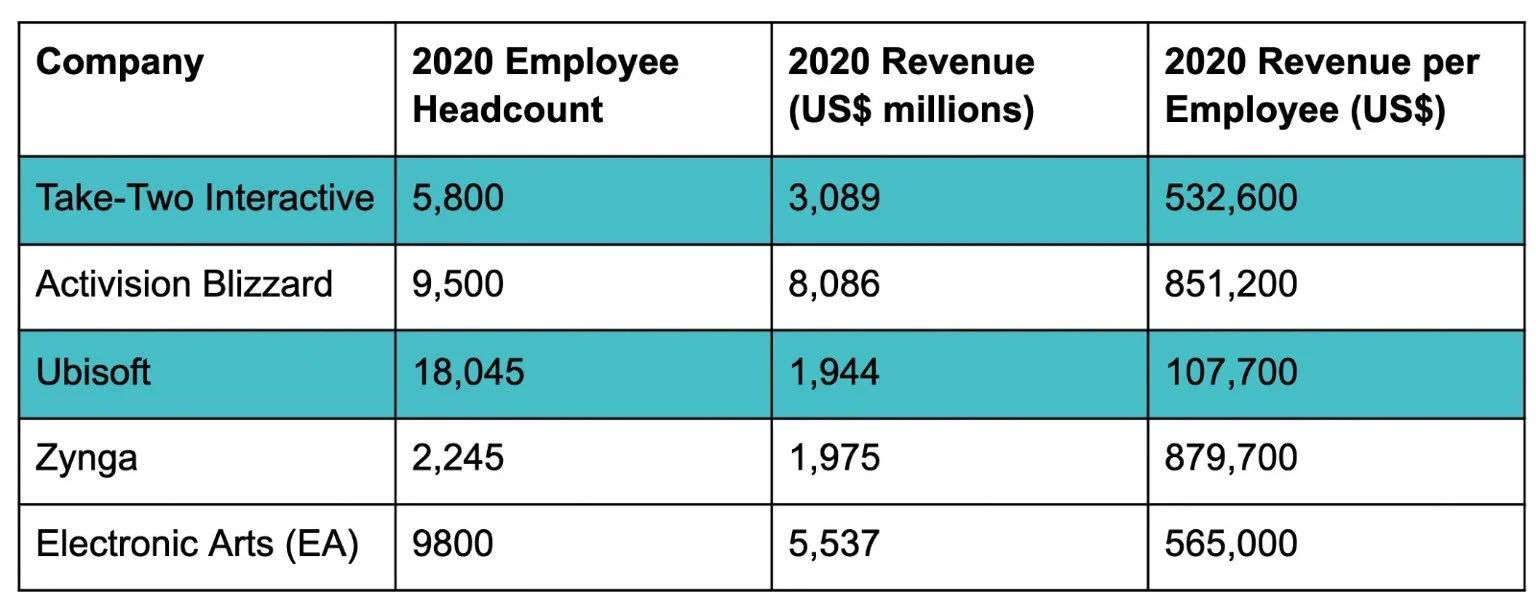

Such an incentive also ensures that employee headcount does not balloon. The table below highlights Ubisoft’s labour inefficiencies, with revenue per employee a fraction of its peers. Over the 4 years between 2016 and 2020, Ubisoft’s revenue increased from US$1.70 billion to US$1.94 billion (a CAGR of only 3.4%), while its headcount increased from 10667 to 18045 (a CAGR of 14.0%). The growth of headcount significantly restricts profitability, with Ubisoft generating losses in FY2020 (before recovering to profitability in FY2021). Without addressing the issue, earnings are likely to come under pressure.

Sporting edge

Take-Two’s ownership of the 2K series gives the company a key competitive edge over Ubisoft, which does not have any core sports franchise. Sports titles enjoy higher barriers to entry and reliable annual release cycles, while benefiting from lower creative risk and a stickier customer base. NBA 2K is the best-selling basketball simulation game in the US based on dollar sales and units, and has sold around 110 million units globally. The 2K portfolio is not limited to basketball, with wrestling and golf also key sports franchises. In March, Take-Two signed a deal with Tiger Woods to promote PGA TOUR 2K21, which was released in December 2020. The game has already sold around 2 million units to-date and was the fastest-selling golf game by units over the past 10 years.

Considering that Take-Two’s most recent seven year agreement with the NBA was inked at a value of US$1.1 billion, game developers require significant capital just to have the opportunity to compete with Take-Two… and that’s before spending a dollar on game development.

The fund has a particular edge in sporting franchises. We understand the benefits and risks of sporting partnerships and believe that Take-Two is well-positioned to maintain long-term agreements with key sporting bodies. This missing piece of the jigsaw for Ubisoft is difficult to overcome if the major bodies are content with their respective partners.

The NBA 2K Series. Image: March 2021 Investor Presentation

Valuations and scale

Franchises offer large developers something of a virtuous cycle, whereby significant capital requirements lock out poorly capitalised competitors and lucrative annual releases generate long-term revenue from a highly-engaged customer base. For example, Take-Two has a pipeline of 93 titles planned over the next 5 years, leveraging on past successful brand building to enjoy increased economies of scale. The virtuous cycle has contributed to Take-Two’s formidable operating cash flow profile and balance sheet strength.

Take-Two’s operating cash flow profile. Image: March 2021 Investor Presentation

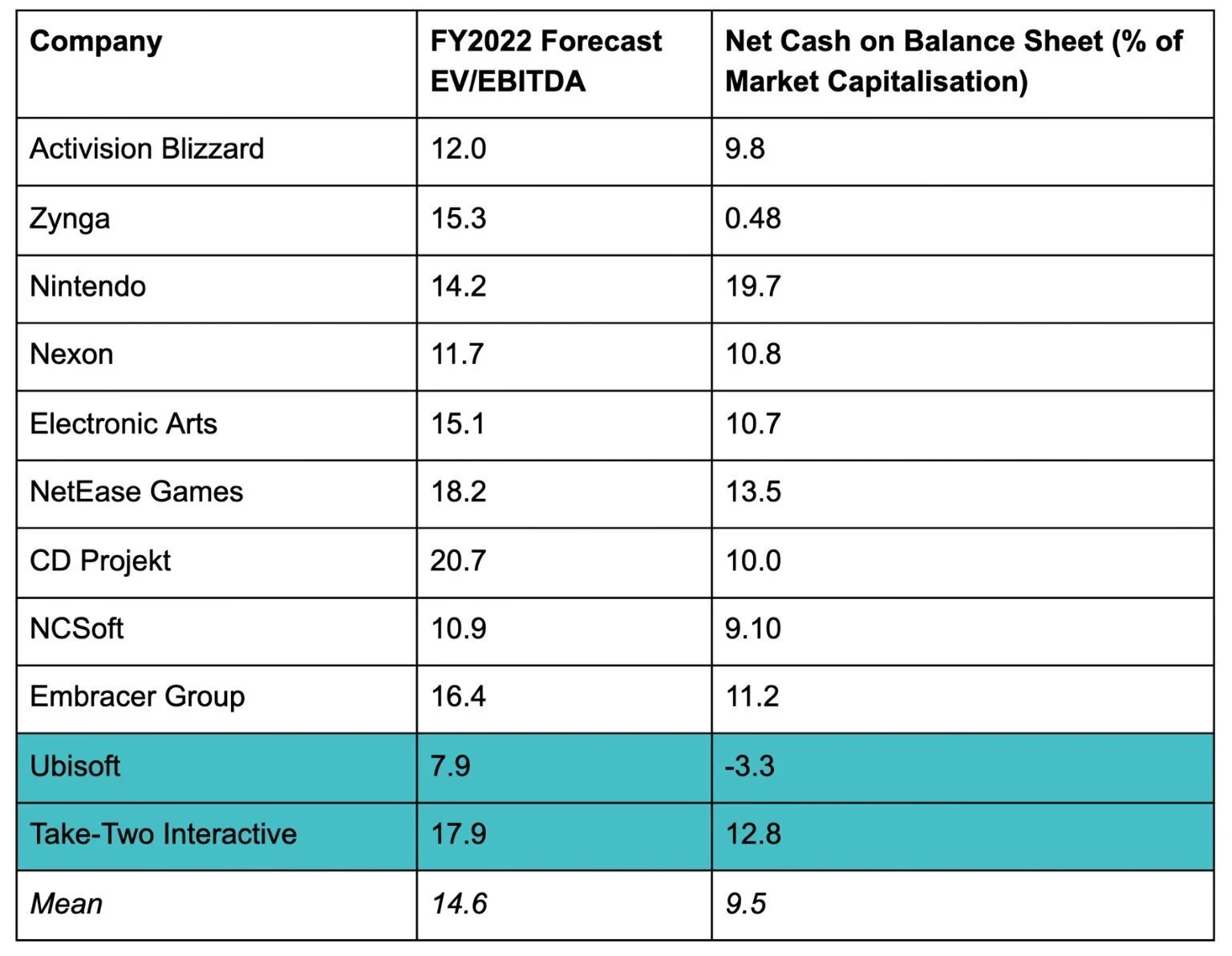

Take-Two has US$2.7 billion of net cash on the balance sheet, providing significant optionality. In contrast, Ubisoft has US$290 million of net debt. Whilst Take-Two trades at a slight premium relative to listed peers, we believe that the premium is justified and that the business could outperform EBITDA forecasts through its superior suite of franchises across multiple segments.

Take-Two and Ubisoft valuation compared to listed peers (as at 11 June, 2021)

Take-Two retains a driven and well-aligned management team with an exciting pipeline of titles. As part of our concentrated strategy, we aim to pick a handful of winners within each industry segment and have ultimately chosen Take-Two over Ubisoft.

For wholesale investors that want to follow gaming’s global growth, please follow us for updates on Twitter @waterhousevc.

Please note the above information in relation to Take-Two Interactive and Ubisoft Entertainment is based on publicly available information in relation to each of them and should not be considered nor construed as financial product advice. The Fund currently has a position in Take-Two Interactive. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

Gambling Fund gross performance as at 31 May 2021