Welcome to the April 2021 newsletter for the Waterhouse VC Fund.

The Fund specialises in gambling assets and businesses that are related to the gambling industry. The industry is under-researched by most mainstream fund managers. We aim to leverage our unique expertise and existing assets to generate capital growth for investors over the long-term.

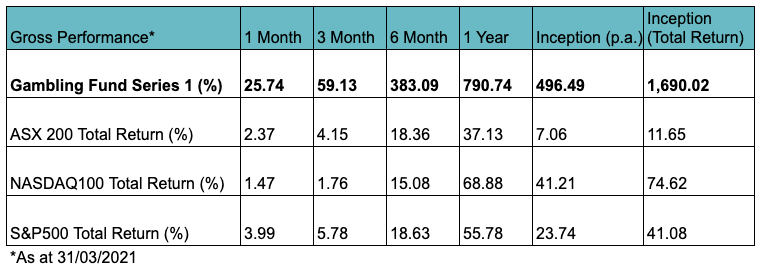

Since inception in August 2019, the Waterhouse VC Fund has achieved a total return of 1,690.02% (assuming the reinvestment of all distributions). The unit price is $17.89, as at 31 March 2021. See our long-term performance table at the end of this newsletter.

A ‘nifty’ new trend

In Australia, low interest rates, population growth, tax concessions and a property-obsessed nation have contributed to booming real estate prices for decades. It’s easy to forget that this isn’t the case everywhere. It’s true that we’re not making any more land, but supply shocks have hit many property markets.

However, one certain type of real estate consistently attracts strong investor interest and commands ever higher prices, so-called “trophy assets”. These properties typically have strong fundamentals underpinning the value, like the land size and location, but really command a premium for their scarcity and bragging rights.

Prices of scarce assets are booming, and not just in the physical world. Collectibles and even real estate have moved into the digital space in the form of non-fungible tokens, or NFTs. If you’re not familiar with this new type of digital asset, we recommend this guide to understand the basics.

NFTs have no tangible form, but are simply a digital certificate of authenticity. The underlying assets, such as images, videos, audio or Jack Dorsey’s first tweet can be copied, but ownership cannot be faked.

Jack Dorsey’s first tweet, which sold for over US$2.9m. Image: twitter.com

A brave new (virtual) world

The ability to issue scarce, censorship-resistant digital assets is enabling developers to create new experiences. There has been explosive growth in the development and popularity of decentralised virtual worlds, which are developed by the community and hosted and replicated across a network of independent servers. The oldest of these virtual worlds is Decentraland.

Everything in the Decentraland virtual world - called the “Metaverse” - is owned by users who create, experience and monetise content and apps. Decentraland raised US$25m in an ICO for its MANA token, the in-game virtual currency. The creators also sold US$10m of LAND, which is an NFT that represents land in the game. Players can exchange MANA for LAND (which is then removed from circulation), or exchange it with other players for goods or services hosted within Decentraland.

To ensure the value of every LAND parcel remains stable, the amount of land in Decentraland corresponds to the fixed, total amount of MANA. This programmed, fixed supply makes every parcel an irreplaceable trophy asset, which welcomes speculation. In 2019, land in Decentraland was selling for about US$500 a parcel, while today the same parcels trade for around US$14,500.

All sorts of scenes and structures have been created by community members. Image: decentraland.org

Decentraland of opportunity

The immutable scarcity of LAND laid the foundation for what has become a thriving economy. Artists, builders, developers and enthusiasts have full control over the environments and applications they create on their land, which can range from anything like static 3D scenes (e.g. billboards) to more interactive applications or games (e.g. Battle Racers). Some parcels are further organised into themed communities, or Districts. By organising parcels into Districts, users can create shared spaces with common interests and uses.

Freedom to monetise assets built on each parcel supports valuations. Contributors are incentivised to create great content that will earn revenue and justify their investment in the LAND. This further attracts more users that want to spend and invest in Decentraland.

Another reason players are going to Decentraland is to seek a better life than they have in the real world. Friendships, entertainment, privacy and status are more attainable in the virtual world for many people. Compared to centralised virtual worlds like Fortnite and Minecraft, where a company is the true owner and moderator of the metaverse, Decentraland provides a more democratic home to invest your time and energy. Nobody has the power to change the rules, tell you what to do on your LAND or modify the economics of MANA. The potential to live out your life in Decentraland becomes even more compelling as VR technology improves.

Like a social media platform, Decentraland becomes more valuable as users grow, which allows landowners to invest in content and attract further users. Compared to the scale of the internet, there are few other notable metaverses that have grown to this size.

Map of the Decentraland “Metaverse”. Image: nftplazas.com

Ready Punter One

In March this year, arcade gaming pioneer Atari announced that it will build a virtual reality casino in Decentraland, in partnership with Decentral Games (of which it is also a 20% shareholder). Atari Casino will live on a 20 land parcel estate in the Vegas City District, a digital sin city, party town gambling district of Decentraland. Atari Casino will feature Atari-themed games, which we expect to be popular with users compared to the more generic-looking games at the moment.

The Atari Casino will join two other casinos in Vegas City: Tominoya and Chateau Satoshi. Our research indicates that nearly all visitors to Decentraland are already gambling in the Vegas City District. Players can browse the casinos and gamble on classic casino games like blackjack, roulette, slots or backgammon with other players and real-life hosts. To gamble, players must first purchase or transfer MANA or DAI tokens to their Decentral Games wallet, which they can stake on certain games. Minimum stakes are very low which allows anyone to get involved. As players gamble, they are rewarded with DG (Decentral Games) tokens, a process popularly known as mining. Holders of DG have the right to vote on governance of the Decentral Games ecosystem, ensuring players have a vested interest in its success.

A look inside the Vegas City District. Image: nftplazas.com

We believe the continued development of Decentraland, especially its gambling district, has the potential to support the valuation of the in-game tokens and land. The partnership with Atari will go a long way to attracting a critical mass of players, and further partnerships will grow the ecosystem further. More broadly, the entire real-world gambling ecosystem is being rebuilt in virtual worlds, presenting opportunities to startups and risks to established operators. It is likely a multi-billion dollar opportunity that is still at the very early stages.

For wholesale investors that want to follow gaming’s global growth, please follow us for updates on Twitter @waterhousevc.

Please note the above information in relation to Decentraland and Atari is based on publicly available information in relation to each of them and should not be considered nor construed as financial product advice. The Fund currently does not have a position in Decentraland or Atari. The Fund currently has a position in Bitcoin. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

Gambling Fund gross performance as at 31 March 2021