Welcome to the November 2021 newsletter for the Waterhouse VC Fund.

The Fund invests in global publicly listed and private businesses related to wagering and gaming. The Waterhouse family has been involved in these industries for over 100 years, and the family’s experience, contacts, and capital provide opportunities that most funds would neither appreciate nor have access to.

Since inception in August 2019, the Waterhouse VC Fund has achieved a total return of 2,615% (assuming the reinvestment of all distributions). The unit price is $27.14, as at 31 October 2021. See our long-term performance table at the end of this newsletter.

Play time is over

We have been shareholders of Playtech (first covered in our June 2020 newsletter) since May 2020 and planned on holding the position for multiple years so long as they continued to grow their core all-in-one software for wagering operators. Playtech licenses its software to third-party operators such as Caliente, Flutter and bet365, typically charging them a portion of revenue. We were incredibly excited about Playtech’s US growth opportunity because the complexity of individual state-by-state legislation meant operators had no time to build reliable advanced software in-house and would simply outsource.

However, our excitement had a bittersweet ending. On 17 October, Aristocrat Leisure (ASX:ALL) offered cash of $5bn (implied equity value of $3.9bn) for the business, representing a significant 58% premium to Playtech's last closing price and an undemanding valuation multiple of 11.4x EBITDA. Whilst we believe that Playtech is in the midst of a multi-year growth period, the expertise of the fund does not include transaction arbitrage. We consequently exited the position at around the offer price of 680 pence, crystallising a gain of 190%.

Considering that the deal is expected to close during the second quarter of 2022 and remains subject to several regulatory approvals as well as 75% Playtech shareholder approval, we believe that our capital is best allocated elsewhere. The Playtech directors intend to recommend unanimously that shareholders vote in favour of the offer.

Aristocrat’s reasoning

The acquisition provides immediate scale to Aristocrat in the US$70bn real money gaming industry, with increased opportunities to distribute Aristocrat’s gaming content. Aristocrat could also improve the performance of Playtech’s non-core game business, achieving operating cost and scale benefits. By combining the two firms’ distribution, technology and content, Aristocrat will be able to service a broader range of customers with an extensive product offering. The acquisition is expected to be accretive on an earnings per share basis.

Interconnected gaming network attracting the industry's leading content creators to deliver a platform for Aristocrat’s long-term growth. Source: 18 October 2021 Investor Presentation

B2C or not to be

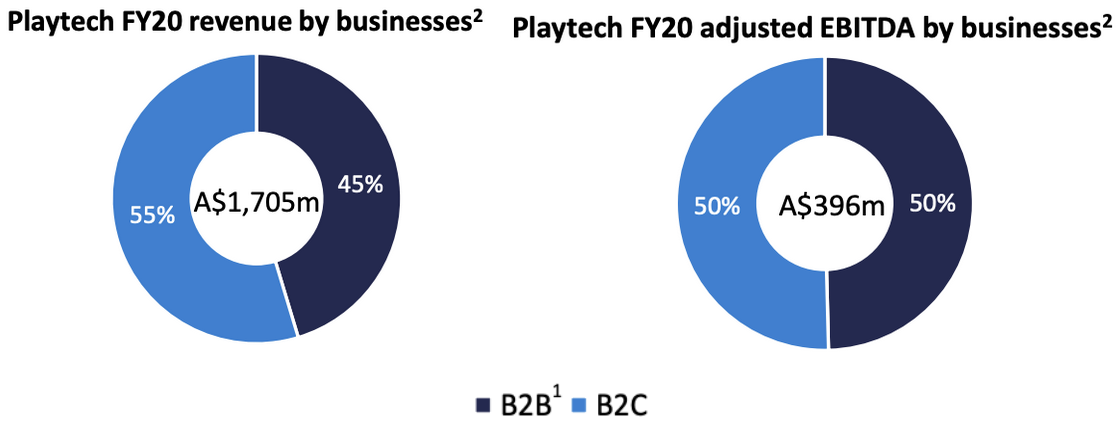

Prior to the acquisition, Aristocrat already had customer and regulatory relationships with Playtech’s B2B offering. However, Playtech derives just over half of its revenue and half of its EBITDA from B2C businesses.

Playtech’s FY20 revenue and EBITDA by business. Source: 18 October 2021 Investor Presentation

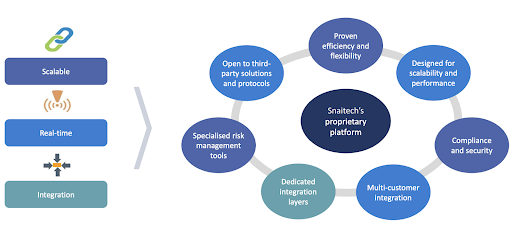

88% of the B2C revenue is derived from Snaitech, which is the second largest omni-channel wagering and gaming operator in Italy with around 1,600 franchised retail shops. Snaitech provides Aristocrat the capabilities to operate directly in Europe and own more of the value chain by integrating their software with Snaitech.

Snaitech’s wagering system is a proprietary platform with a focused set of integrated products and solutions. Source: 18 October 2021 Investor Presentation

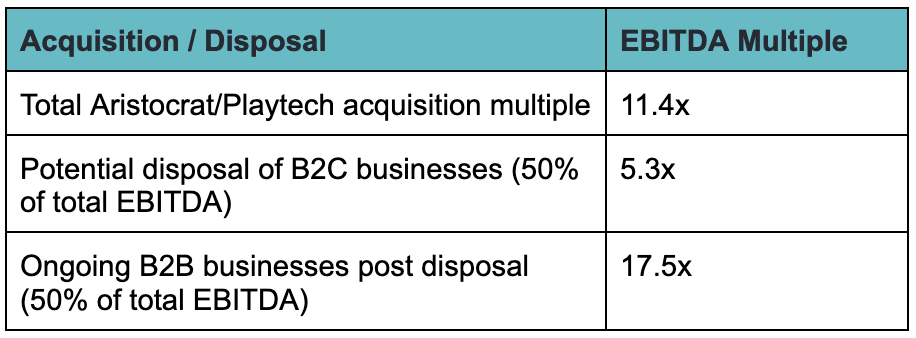

However, Aristocrat does not have particular operational expertise running B2C businesses and may ultimately dispose of Snaitech and Playtech’s other B2C businesses. We see this as a potential risk as European operators are usually valued at low earnings multiples. For example, earlier this year, Apollo bought Italian operator, Lottomatica, for 5.3x EBITDA.

The below table illustrates our basic calculation of the effective ‘ongoing’ EBITDA multiple if Aristocrat disposes of Playtech's B2C businesses for 5.3x EBITDA. This ‘ongoing’ multiple indicates the effective multiple paid for the B2B businesses. If the disposal occurs at 5.3x, Aristocrat has effectively paid 17.5x EBITDA for Playtech’s B2B businesses.

The effective multiple paid for Playtech's B2B business

Playtech’s exposure to unregulated markets

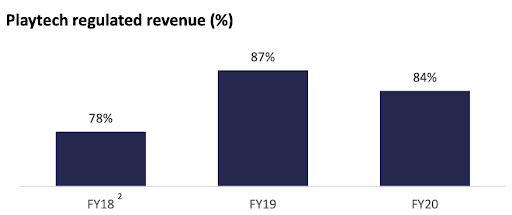

Post acquisition, management will review Playtech’s businesses in each jurisdiction to determine alignment with Aristocrat’s risk appetite and compliance. 16% of Playtech's FY2020 revenue came from unregulated markets - these operations may be sold off to align with Aristocrat's preference for regulated markets (although the US also carries some regulation risk). The operations would likely sell at lower earnings multiples than the 11.4x that Aristocrat paid for the whole Playtech business.

Playtech’s regulated revenue as a proportion of total revenue. Source: 18 October 2021 Investor Presentation

Will counter-bidders make a play for Playtech?

The potential for counter-bids is high despite the significant premium offered by Aristocrat and Playtech directors’ recommendation to accept the bid. Aristocrat’s bid values Playtech at a discount to listed peers such as Evolution Gaming (39x 2021 EBITDA), GAN (56.7x 2021 EBITDA) and Scientific Games (12.5x 2021 EBITDA). Whilst Aristocrat, having completed a long due diligence process, is undoubtedly best positioned to emerge as the ultimate owner of Playtech, there is significant global interest in Playtech’s online gaming and sports betting turnkey solutions.

Our stance on Aristocrat

Aristocrat has been an Australian stalwart since its foundation in 1953. The business is well-known for its excellent forward-looking management, who have delivered a circa 1,900% return to Aristocrat shareholders over the last 10 years through both organic and inorganic growth. Management’s fortitude is exemplified by their consistent history of deleveraging following strategic acquisitions.

Aristocrat’s consistent history of deleveraging following acquisitions. Source: 18 October 2021 Investor Presentation

We have not previously held Aristocrat on valuation grounds. Like most high quality public businesses, Aristocrat does not command a low valuation. At 35x PE / 20x EBITDA, we believe that Aristocrat is fairly priced.

Aristocrat will have a higher quality B2B offering and a more diversified business with Playtech brought into the fold. We are confident in the continued growth of the combined group, which is a key barometer for the growth of the entire global gaming and wagering industry.

Media: Ausbiz’ Game On!

Waterhouse VC participated in Ausbiz’s ‘Game On!’ event focused on gaming, wagering and tech. Technology has revolutionised the way we play and wager on sport. The event covered investment opportunities in the technology powering the industry. See our contribution to the event in this video.

For wholesale investors that want to follow gaming’s global growth, please follow us for updates on Twitter @waterhousevc.

Please note the above information in relation to DraftKings, Entain, Flutter Entertainment, Kambi and Penn National is based on publicly available information in relation to the companies and should not be considered nor construed as financial product advice. The Fund currently has a position in Flutter Entertainment and Penn National. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

Waterhouse VC Fund gross performance as at 30 September 2021