Welcome to the December 2021 newsletter for the Waterhouse VC Fund.

The Fund specialises in global publicly listed and private businesses related to wagering and gaming. The Waterhouse family has been involved in these industries for over 100 years, and the family’s experience, contacts, and capital provide opportunities that most funds would neither appreciate nor have access to.

Since inception in August 2019, the Waterhouse VC Fund has achieved a total return of 2,329.65% (assuming the reinvestment of all distributions) as at 30 November 2021. See our long-term performance table at the end of this newsletter.

Betting exchanges vs bookmakers

When a bettor uses traditional bookmakers (such as Sportsbet or bet365), they place a wager on the odds offered by the bookmaker, essentially going up against the bookmaker. If the wager wins, the bookmaker loses (and vice versa). Bookies set the odds by estimating the probabilities and then slightly adjusting the odds down to build in a margin for themselves. This margin is typically around 7% for sports and 15% for horse racing.

In contrast, on betting exchanges like Betfair, bettors take on each other rather than the bookmaker. This is similar to other markets like stock exchanges. Bettors are required to set the odds and other bettors must match them for a wager to occur. The loser of the wager then pays out the winner and the exchange takes a commission on the winnings. The commission varies by market but typically averages around 5%. Fundamentally, the exchange is the middle-man facilitating the wager.

Betfair - an early entrant

The earliest betting exchanges emerged around 2000 when entrepreneurs realised that an exchange could take no wagering risk while providing better odds by charging a commission lower than traditional bookmakers’ margin. The first exchanges were Matchbook, Flutter and Betfair (Flutter and Betfair subsequently merged). Betfair now operates in over 100 countries and is the clear industry leader, counting over 1.4 million average monthly players.

Out of Flutter’s five divisions, Betfair (combined with Paddy Power) was the largest contributor to revenue in 2020, generating US$1.7 billion out of Flutter’s total revenue of US$7.0 billion. We recently discussed Flutter in our September newsletter and are confident in the continued growth of Betfair’s contribution to the company.

New betting exchanges are an interesting part of the wagering ecosystem and are well-positioned to disrupt the industry, particularly in the nascent US market. Consequently, we are assessing and have invested in several betting exchanges, which we will discuss in future newsletters.

Bookies don’t always win

Similarly to the early betting exchange entrepreneurs, “Bookies always win” was a statement that BetConnect’s founder, Dan Schreiber, wanted to address.

Dan was frustrated with bookmaker restrictions, founding BetConnect in 2018 with the idea for a wagering ecosystem that allows professional sports bettors to get their selections placed and everyday bettors to make more informed bets. The company has grown to 24 people and is an exciting challenger betting exchange, targeting recreational bettors through a sportsbook look and feel. BetConnect achieved £1m in monthly matched bets faster than any exchange in history and now records around £4m in monthly matched bets.

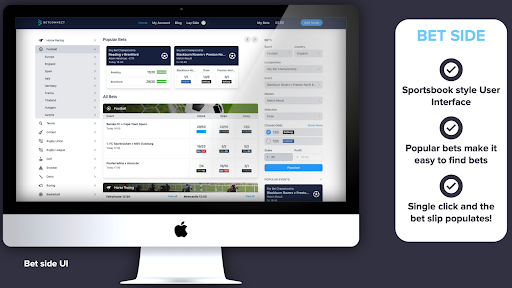

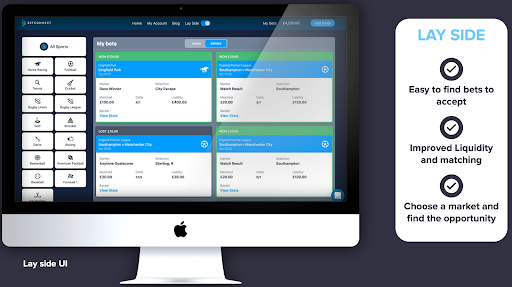

The company’s hybrid model appeals to users who find exchange platforms daunting and prefer a typical sportsbook UI. Access to industry leading prices through one app is a major attraction for recreational users. Unlike competing betting exchanges, BetConnect scours the market picking up prices from all major bookmakers and offers the best prices to recreational users. The company is home to some of the UK’s biggest sports bettors, seeing five-figure bets regularly matched in full at market-leading prices. Unlike other exchanges, recreational users play as vital a part in the BetConnect ecosystem as the pros.

On the ‘Bet’ side of the exchange, BetConnect takes up to 2% commission from professional bettors, who need liquidity. Whilst the ‘Lay’ side is free now, BetConnect is introducing a subscription revenue stream for matched bettors.

BetConnect’s Experienced Leadership Team. Source: BetConnect

Bet, lay… or subscribe

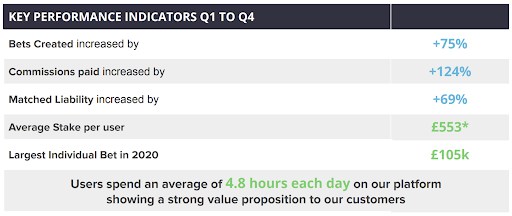

Access to industry leading prices through one app could be a major attraction for the recreational user. As demonstrated by key performance indicators in 2020, early adopters (generally, professionals) are already highly engaged.

BetConnect’s Key Performance Indicators. Source: BetConnect

BetConnect’s Bet Side of the Exchange. Source: BetConnect

BetConnect’s Lay Side of the Exchange. Source: BetConnect

The company is innovating on the traditional exchange model, launching paid subscription plans. One of the proposed plans offers users 0% commission, while the ‘Matched Bettor’ subscription leverages the platform’s ability to meet the demands of matched bettor and arbitrage traders with a unique pool of bets. A previous trial with matched bettors led to a huge influx of players. BetConnect will attract subscriptions, and prized recurring revenue, by utilising commission-based deals with large affiliate networks.

US opportunity

Due to the Wire Act, there would need to be 50 individual pools for a betting exchange, one for each state. This challenges the viability of a US exchange business because liquidity must be provided to each of the pools. However, prospective US exchanges are currently working directly with various US agencies regarding an approach to operating an exchange across state lines.

Despite its challenging framework, the US market offers a lot of appeal and opportunity for BetConnect. The business is well positioned to take advantage of the opportunity not only as an operator but also with their extensible B2B offering.

Growth strategy

BetConnect’s growth strategy aims to increase their customer base in the existing exchange, expand the product offering to include whitelabel / brand offerings, expand internationally (including to the United States), extend technology for ‘Gambling as a Service’ products, and adapt to blockchain technology. The BetConnect model can be flexibly adapted to accommodate blockchain assets and the inherent benefits of better margins, lower transaction costs and faster withdrawals. Being a smaller operator allows BetConnect to be more agile and commercial than larger listed companies in the industry.

Valuation

BetConnect has grown revenues at a >35% CAGR and is on track to be EBITDA-positive by early 2022. It is important to note that whilst exchange businesses have a large fixed cost base, they benefit from extraordinary economies of scale as liquidity is added to the exchange.

Waterhouse VC recently purchased an initial stake in BetConnect and also has a 3-year option to make an additional investment at a compelling valuation of 1.14x forecast 2022 revenue / 3.11x forecast 2022 EBITDA. As outlined in our September newsletter, wagering industry peers are valued at an average revenue multiple of 4.4x and EBITDA multiple of 15.8x.

We are excited by BetConnect’s unique product proposition and market fit. With strong plans to grow internationally and build long-lasting partnerships, we look forward to being a part of BetConnect’s journey.

Media: Chris Judd’s Talk Ya Book

In September, Tom appeared on Chris Judd’s Talk Ya Book to discuss Waterhouse VC’s past performance, the global racing industry and the fund’s core position in Betmakers. Tom and Chris also discuss the huge potential of the nascent US wagering industry. Watch the discussion here.

For wholesale investors that want to follow gaming’s global growth, please follow us for updates on Twitter @waterhousevc.

Please note the above information in relation to Flutter Entertainment and BetConnect is based on publicly available information in relation to the companies and should not be considered nor construed as financial product advice. The Fund currently has a position in Flutter Entertainment and BetConnect. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

Waterhouse VC Fund gross performance as at 30 November 2021