Waterhouse VC (a fund for wholesale investors) holds a blend of diversified global listed equities and unlisted investments, leveraging the Waterhouse family’s core areas of expertise. The portfolio is split across three pillars: Option Deals, Global Equities, and Professional Betting.

Since inception in August 2019, Waterhouse VC has achieved a gross total return of 2,858% as at 29 February 2024, assuming the reinvestment of all distributions.

Athos, Porthos & Aramis

In every industry, there are prominent figures who stand out, and the wagering industry is no exception. This month, we shine a spotlight on three distinct leaders in the industry: Tim Heath, a crypto wagering pioneer; Peter Jackson, the CEO of Flutter Entertainment (listed on the FTSE100); and David Walsh, renowned as one of the world’s largest professional horse racing gamblers.

Over the last decade, the online wagering industry has expanded significantly through the proliferation of mobile-focused platforms. Tim Heath and Peter Jackson lead companies at the forefront of digital innovation in the industry.

YOLO

Originally from Australia, Tim Heath is a serial wagering industry entrepreneur and venture capitalist. After university, Tim started a software development and e-commerce firm, heathmont.net. In 2013, he launched Coingaming Group (rebranded to Yolo Group in 2021), a crypto wagering operator and supplier. Yolo Group is now most known for its large B2C wagering operators, Sportsbet.io and Bitcasino.io. We have discussed the rapid growth of crypto wagering and Sportsbet.io in previous newsletters.

Southampton FC sporting the Sportsbet.io logo. Source: Sportsbet.io

With over 600 employees, Yolo is a well-established group of businesses across wagering and venture investing. Yolo’s B2C brands pioneered the integration of streaming for all major sports and they were very early innovators of the now common ‘cashout’ feature. Sportsbet.io and bitcasino.io offer players withdrawal times as fast as just 1.5 minutes, ranking among the swiftest in the industry. Tim’s relentless focus on customer experience has made Sportsbet.io one of the largest global crypto wagering operators. The company records over US$2.7bn of turnover per month. To put that in perspective, in 2023, Australia’s largest operator averaged US$1.2bn of turnover per month and has around 50% market share in the country.

What is next for Tim? One thing he would like to reform is the international payments landscape, which today predominantly relies on the SWIFT system. He believes that SWIFT has several inefficiencies, such as delays and lack of privacy.

If you would like to learn more about Tim’s journey with Yolo, I recommend that you listen to this podcast.

World domination

Peter Jackson has been the CEO of Flutter Entertainment since January 2018. Under his stewardship, the company’s valuation has doubled and it is now the world’s largest publicly listed wagering company. Only Bet365 (privately owned by the Coates family) comes close to Flutter in global scale. Flutter is the only publicly listed B2C wagering operator in our portfolio at Waterhouse VC.

Jackson graduated with a degree in manufacturing engineering from Cambridge and honed his skills during a three-year stint at McKinsey. He then transitioned to various roles at the Halifax Bank of Scotland until its acquisition by Lloyds in 2009. At 34, he was appointed the CEO at Travelex, a foreign exchange company. He led the company for five years, bolstering revenues and eventually overseeing its £1 billion sale. He served on the board of Betfair since 2013 before being appointed Flutter’s CEO five years later.

Early on in his tenure, Jackson recognised the importance of scale and efficiency in an industry which is highly taxed and highly regulated. Leveraging his experience in consulting and banking, Jackson has developed operations that lead their respective markets through a combination of organic expansion and M&A activity (such as MaxBet and Junglee Games).

Flutter’s global brands. Source: Flutter Entertainment Plc

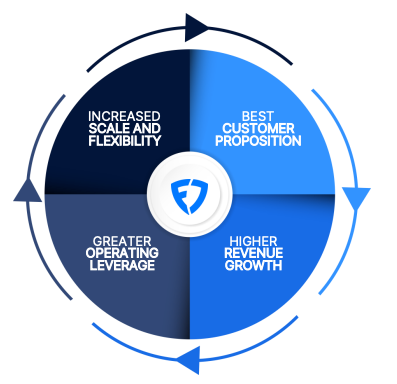

By leveraging the broader Flutter group’s access to global industry knowledge, technological development, customer insights, and data analytics, each of Flutter’s divisions benefits from a ‘flywheel’ effect. This ‘flywheel’ has driven Flutter’s US business, FanDuel, to an 11-fold increase in revenue from US$300 million in 2018 to around US$3.3 billion in 2022, with an industry-leading 37% market share today.

Flutter’s flywheel. Source: Flutter Entertainment Plc

Jackson was instrumental in effecting the recent dual-listing of Flutter on the New York Stock Exchange (NYSE:FLUT). The company listed on 29 January this year, enhancing access to US capital markets and simplifying the provision of stock incentives to employees based in the United States. Historically, US equities have commanded higher valuations compared to other global equity markets. Flutter's shareholders stand to gain from an increased valuation, while the company could leverage its premium valuation to raise cheaper additional capital.

Peter Jackson ringing the opening bell on the New York Stock Exchange. Source: Youtube

MONA

The wagering industry provides entertainment to people at a cost. There is a very small group of people who bet profitably - they do not need to pay for the entertainment.

We believe that globally, there are fewer than 50 betting syndicates capable of winning at scale. David Walsh is regarded as one of the world’s most successful gamblers through the syndicate in which he is partnered with Zeljko Ranogajec. The syndicate bets globally on horse racing, sports, lotto, casino and financial markets. It has been reported that the syndicate turns over in excess of $3Bn per year, however some estimate that their global turnover is far higher.

Walsh invested $75 million to open the Museum of Old and New Art (MONA). As a result of his contributions, Walsh was honoured as an Officer of the Order of Australia (AO) for his outstanding service to the visual arts and for his support of various cultural, charitable, sporting, and educational organisations.

Professional bettors are incredibly bright and have a rare skill-set. They understand the unique dynamics of each sporting code/casino game/lottery back to front. They are able to model 100s of factors that predict the ‘true’ likelihood of a result. Then they can put it all together to actually run a professional betting business, which relies on managing a huge number of people.

Focusing on racing in particular, a team of experts in mathematics, statistics, and computer science regularly develop, maintain and refine algorithms that assess vast amounts of historical racing data and individual factors specific to racing (such as track conditions, jockey statistics, sectionals, weather and bloodlines) to inform betting decisions.

As discussed last month, racing betting syndicates are also advantaged by receiving rebates on their wagers regardless of the outcome. To qualify for the rebates, syndicates must wager vast amounts of money. The rebates effectively enhance their existing 'edge,' making it increasingly challenging for emerging syndicates to compete in racing.

Media

I recently spoke with Sharewise to discuss Waterhouse VC’s three investment pillars, our due diligence process, and the intersection of crypto and wagering. Watch the webinar here.

For wholesale investors interested in following wagering and gaming industry news and trends, please follow our updates on Twitter (@waterhousevc) or through our website at WaterhouseVC.com.

All the best,

Tom

DISCLAIMER AND IMPORTANT NOTES

Please note the above information in relation to Peter Jackson, Flutter Entertainment Plc, TabCorp, David Walsh, Zeljko Ranogajec, Tim Heath, Sportsbet.io, Bitcasino.io, Yolo Group, Bet365, Sportsbet and FanDuel is based on publicly available information in relation to the company and should not be considered nor construed as financial product advice. The Fund currently has a position in Flutter Entertainment Plc. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

General Information Only

This material is for general information only and is not an offer for the purchase or sale of any financial product or service. The material has been prepared for investors who qualify as wholesale clients under sections 761G of the Corporations Act or to any other person who is not required to be given a regulated disclosure document under the Corporations Act. The material is not intended to provide you with financial or tax advice and does not take into account your objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by Sandford Capital, Waterhouse VC or any other person. To the maximum extent possible, Sandford Capital, Waterhouse VC or any other person do not accept any liability for any statement in this material.

Financial Regulatory Oversight and Administration

Waterhouse VC is an Australian Unit Trust denominated in AUD and available to wholesale institutional investors worldwide with a minimum of AUD 1,000,000 or USD / EUR / GBP / JPY / CHF equivalent. This material has been prepared by Waterhouse VC Pty Ltd (ABN 48 635 494 861) (‘Waterhouse VC’, ‘Trustee’, ‘us’ or ‘we’) as the Trustee of the Waterhouse VC Fund (the ‘Fund’). The Trustee is a corporate authorised representative (CAR 1278656) of Sandford Capital Pty Limited (ABN 82 600 590 887) (AFSL 461981) (Sandford Capital) and appoints Sandford Capital as its AFS licensed intermediary under s911A(2)(b) of the Corporations Act 2001 (Cth) to arrange for the offer to issue, vary or dispose of units in the Fund.

Performance

Past performance of Waterhouse VC is not a reliable indicator of future performance. Waterhouse VC Pty Ltd does not guarantee the performance of any strategy or the return of an investor’s capital or any specific rate of return. No allowance has been made for taxation, where applicable. We encourage you to think of investing as a long-term pursuit.

Copyright

Copyright © Waterhouse VC Pty Ltd ACN 635 494 861. No part of this message, or its content, may be reproduced in any form without the prior consent of Waterhouse VC.

Governing Law

These Terms and Conditions of use are governed by and are to be construed in accordance with the laws of New South Wales. By accepting these Terms and Conditions of use, you agree to the non-exclusive jurisdiction of the courts of New South Wales, Australia in respect of any proceedings concerning these Terms and Conditions of use.