Waterhouse VC (a fund for wholesale investors) holds a blend of diversified global listed equities and unlisted investments, leveraging the Waterhouse family’s core areas of expertise. The portfolio is split across three pillars: Option Deals, Global Equities, and Professional Betting.

Since inception in August 2019, Waterhouse VC has achieved a gross total return of 2,744% as at 31 January 2024, assuming the reinvestment of all distributions.

Rain Man

For most of us, it is hard to fathom the mathematical capability possessed by a small number of people. It is even more impressive when these individuals can combine several rare skills together with business acumen to develop a highly profitable enterprise. We believe that professional betting is one of the most difficult fields in the world. The three keys to winning at betting are: making correct bet selection; betting at an attractive price; correctly staking (knowing how much to wager on each selection).

Successful professional betting requires a combination of incredibly challenging skills:

Knowing a sport back to front - every player statistic, every last minute change, every location and playing surface (e.g. clay/grass/hard tennis courts, Emirates Stadium vs Etihad Stadium)

Complex modelling of the many 100s of various factors that determine a player or team’s likelihood of winning and consequently, their ‘true’ odds compared to the odds offered by bookmakers (e.g. time since last match, social media activity, injury statistics, travel time to a match, age, weather, and why the market has got it wrong)

Running a betting business (e.g. Managing bet placement, bet settlement risk, accessing rebates, intellectual property theft risk, bet theft / leakage of bets risk)

We believe that there are less than 50 betting syndicates globally that are able to win more than a million dollars per annum through betting, and a handful that win around a billion dollars. Waterhouse VC owns a stake of one of these syndicates, which focuses primarily on tennis. The syndicate’s advantage is challenging to duplicate because of the extensive proprietary historical data that it possesses and the sophisticated factors integrated into its models.

In addition to Waterhouse VC’s stake in ‘Project Tennis’, the fund is exploring further opportunities in professional betting. These opportunities are incredibly hard to find and evaluate without specific domain expertise.

Paid to play

One reason that there are so few successful professional racing betting syndicates is that existing large racing syndicates benefit from receiving rebates on their bets, regardless of result, effectively increasing their ‘edge’ and making it even harder for emerging syndicates to compete. Racing syndicates receive rebates from pari-mutuel/tote betting in exchange for providing liquidity. To qualify for these rebates, syndicates must wager substantial amounts of money. For instance, US totes typically extend rebates solely to those who bet over US$5 million annually (Sports Trading Network). The cumulative effect of their rebate advantage has resulted in substantial profits for the largest syndicates.

Greed is not good

Human behaviour is one of the key contributors to financial cycles as investors swing between fear and greed. Human behaviour allows trading firms to profit from the emotionally driven decisions of retail investors. Such a dynamic also exists in betting, whereby professional betting syndicates can profit from retail gamblers through exchanges like Betfair and Matchbook. Succumbing to fear and greed rather than solely making analysis-driven decisions is a major pitfall for investors and bettors alike. Numerous cognitive biases (for example, the ‘Illusion of Control’) make successful investing and betting incredibly challenging.

Even professional fund managers who possess all necessary technical resources and employ the world’s brightest analysts generally deliver performance below the market to their investors. Over the past decade, 85.6% of active funds have generated lower performance than the S&P 500, with underperformance rates exceeding 80% across developed markets. Warren Buffett, often named the world’s best investor, won a million dollar bet that the market would outperform active management.

Greedily flipping coins

Several experiments have looked into how people think about money and make financial decisions. In one experiment from 2013 by Victor Haghani and Richard Dewey, people played a game where they flipped a virtual coin. They were told the coin had a 60% chance of landing on heads. Each person got $25 to start and could bet however they wanted. After 30 minutes of flipping the coin (time for about 300 flips), they received the final payout, which was limited to $250.

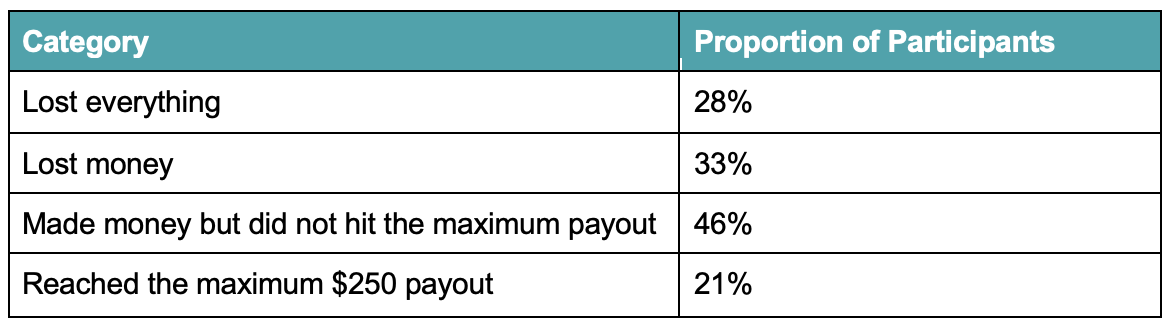

Haghani and Dewey calculated that 95% of people were expected to reach the $250 payout limit. But in the end, 33% of people lost money, and only 21% got to $250. 67% of people even tried their luck at least once betting on ‘Tails’ even though they had been told that ‘Tails’ only had a 40% chance of landing - an example of the ‘Illusion of Control’.

Coin-flipping experiment results. Source: Rational Decision Making under Uncertainty: Observed Betting Patterns on a Biased Coin (Victor Haghani and Richard Dewey)

Kelly Criterion

The principles guiding success in the coin-flipping experiment can be applied to both professional betting and investing. A simple application of the Kelly Criterion (K%) would have effectively maximised the payout from the coin-flipping activity. The Kelly Criterion aids investors and bettors in optimising portfolio or bankroll diversification. It determines the ideal allocation of funds to each individual investment or bet.

Applying the Kelly Criterion to the above coin-flipping experiment results in betting 20% of your money each time (K% = 20%). For example, starting with $25, you'd bet $5 first. If you win, you'd then bet $6 of the $30 you have. If you lose, you'd then bet $4 of the $20 you have left, and so on.

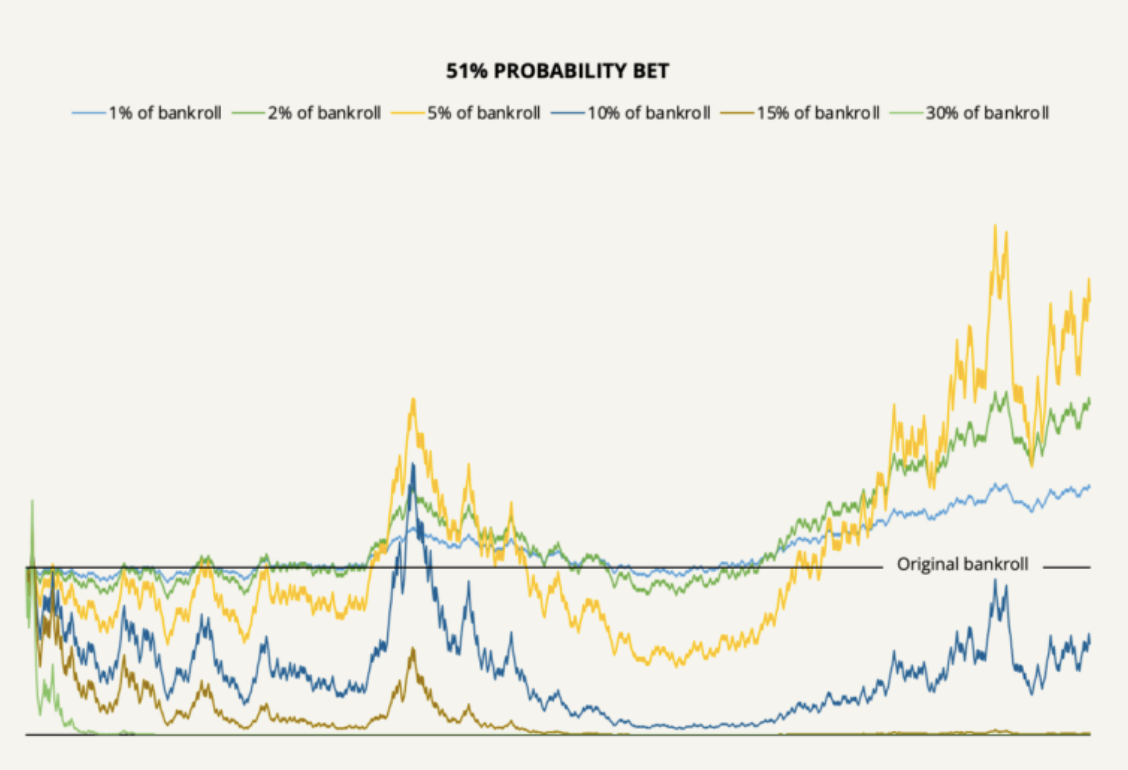

A 1,000-bet simulation of a bet that has a 51% probability of winning. Source: Junto.

Another example highlighting the significance of the Kelly Criterion is presented above with a bet that has a 51% chance of winning. If you bet too cautiously (e.g. 2% of your money each time - refer to the green / second best performing line), you'll do okay but not great. If you bet too much (e.g. 15% of your money each time - refer to the brown / second worst performing line), you'll end up losing everything. This illustrates how crucial position sizing is in both betting and investing - small changes in how much you bet determine whether you succeed or lose everything.

Whilst it is very difficult operationally (selecting and placing bets effectively) and cognitively (overcoming biases and applying Kelly Theory) to win at betting, there are several groups that do so very successfully. If you would like to learn more about professional betting, we discussed the topic in June 2023, April 2023 and December 2022.

Media

I recently joined the ‘Betting Startups’ podcast to reflect back on a Q4 that saw more funding announcements, but also saw some evidence of early-stage companies struggling. The podcast also covered what areas of the industry are exciting from an investment perspective as we look to 2024. Click here to listen on Apple Podcasts or here to listen on Spotify.

I am speaking on ‘Investing in the Innovation Gold Rush’ at SBC Summit Rio 2024. With Brazilian sports betting operators establishing themselves in the new market, the panel will discuss the opportunity for operators as well as the current investment landscape. For more information on the event, see here.

For wholesale investors interested in following wagering and gaming industry news and trends, please follow our updates on Twitter (@waterhousevc) or through our website at WaterhouseVC.com.

All the best,

Tom

DISCLAIMER AND IMPORTANT NOTES

Please note the above information in relation to Betfair and Matchbook is based on publicly available information in relation to the company and should not be considered nor construed as financial product advice. The above information in relation to Thomas Dry and Project Tennis is based on information provided by the company and should not be considered nor construed as financial product advice. The Fund currently has a position in Project Tennis and Flutter Entertainment PLC. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

General Information Only

This material is for general information only and is not an offer for the purchase or sale of any financial product or service. The material has been prepared for investors who qualify as wholesale clients under sections 761G of the Corporations Act or to any other person who is not required to be given a regulated disclosure document under the Corporations Act. The material is not intended to provide you with financial or tax advice and does not take into account your objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by Sandford Capital, Waterhouse VC or any other person. To the maximum extent possible, Sandford Capital, Waterhouse VC or any other person do not accept any liability for any statement in this material.

Financial Regulatory Oversight and Administration

Waterhouse VC is an Australian Unit Trust denominated in AUD and available to wholesale institutional investors worldwide with a minimum of AUD 1,000,000 or USD / EUR / GBP / JPY / CHF equivalent. This material has been prepared by Waterhouse VC Pty Ltd (ABN 48 635 494 861) (‘Waterhouse VC’, ‘Trustee’, ‘us’ or ‘we’) as the Trustee of the Waterhouse VC Fund (the ‘Fund’). The Trustee is a corporate authorised representative (CAR 1278656) of Sandford Capital Pty Limited (ABN 82 600 590 887) (AFSL 461981) (Sandford Capital) and appoints Sandford Capital as its AFS licensed intermediary under s911A(2)(b) of the Corporations Act 2001 (Cth) to arrange for the offer to issue, vary or dispose of units in the Fund.

Performance

Past performance of Waterhouse VC is not a reliable indicator of future performance. Waterhouse VC Pty Ltd does not guarantee the performance of any strategy or the return of an investor’s capital or any specific rate of return. No allowance has been made for taxation, where applicable. We encourage you to think of investing as a long-term pursuit.

Copyright

Copyright © Waterhouse VC Pty Ltd ACN 635 494 861. No part of this message, or its content, may be reproduced in any form without the prior consent of Waterhouse VC.

Governing Law

These Terms and Conditions of use are governed by and are to be construed in accordance with the laws of New South Wales. By accepting these Terms and Conditions of use, you agree to the non-exclusive jurisdiction of the courts of New South Wales, Australia in respect of any proceedings concerning these Terms and Conditions of use.