Welcome to the March 2022 newsletter for the Waterhouse VC Fund.

See below for this month’s Waterhouse VC newsletter. The strategy specialises in global publicly listed and private businesses related to wagering and gaming.

Since inception in August 2019, Waterhouse VC has achieved a total return of 2091% (assuming the reinvestment of all distributions) as at 28 February 2022. See our long-term performance table at the end of this newsletter.

Opportunity in Esports

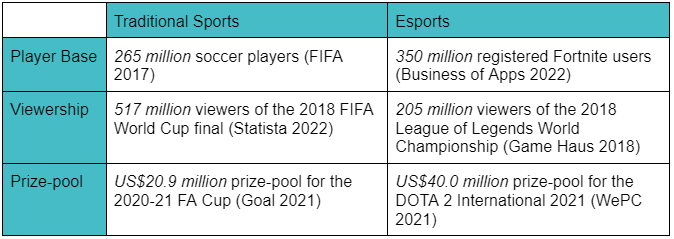

The chances are that you, or a younger relative, have already engaged with Esports. The player bases, viewership and prize-pools of Esports are now comparable with traditional sports. In the US, Esports wagering is already allowed in Nevada, New Jersey, Colorado, and West Virginia, and soon to be allowed in a further 11 states.

The Gross Gaming Revenue (GGR) generated by Esports betting globally was around US$340 million in 2020, equating to just 2.1% of global sports betting GGR. This is expected to grow at 25%pa for the next four years, equating to a future share of 3.2%. When considering the above table, we believe that the GGR generated by Esports will ultimately rival that of traditional sports. It is just a matter of time.

Similarly to the wagering ecosystem for traditional sports, a wagering ecosystem for Esports will undoubtedly emerge and mature, encompassing the provision of odds, risk management, vision services, data analysis, as well as marketing and distribution. B2B service providers to Esports wagering operators are a key area of focus for us. We have already completed thorough due diligence of many Esports wagering service providers, conducting company meetings with both providers and operators that use their services.

Introducing Oddin

Oddin is a B2B provider of Esports odds feed, risk management, and other Esports wagering solutions. It delivers the most engaging Esports wagering experience with industry-leading uptime across 15 live markets. The solution boosts engagement, drives volume, increases margin, and thus accelerates profitability. Having spent time with the Oddin team in Prague, we believe that Oddin is the clear market leader.

Founded in 2018, Oddin has grown to over 70 employees with deep technical backgrounds and experience from Pinnacle, Betfair and William Hill.

Oddin’s experienced team. Source: Oddin

In the last year, Oddin has signed multiple partnerships with both operators and platform providers such as Aspire Global (a Waterhouse VC portfolio holding).

Titles supported by Oddin. Source: Oddin

Oddin’s solution delivers an industry leading average win margin of 6.2% to clients, compared to around 3% for competitors. The company envisions that in five years, more than 40% of Esports wagering revenue in the United States will pass through the company’s various solutions.

The calculation of profitable and engaging odds feeds would not be possible without Oddin’s low latency infrastructure, access to official data, experienced trading team and deep technical expertise.

Oddin typically takes a 10-20% share of GGR from clients. The company is well-positioned to achieve significant revenue growth in 2022. They are forecast to achieve US$12m of revenue in 2022 and have a long runway to continue growing rapidly.

Media: ICE VOX 2022 and Sportico

Tom is speaking at ICE VOX 2022, the pre-eminent international gaming conference. Join Tom at Capital Suite, ExCeL London on 11 April.

In February, Sportico published a piece about Waterhouse VC, covering several of our positions (with a particular focus on Voxbet and BetMakers) and the exciting growth of Esports wagering: “These days Waterhouse is also turning his attention to the potential for esports wagering in the U.S. Waterhouse suspects esports betting will be huge, since in Australia, it has been the fastest growing sector.”

Please note the above information in relation to Oddin is based on publicly available information in relation to the company and should not be considered nor construed as financial product advice. Waterhouse VC has a potential option deal with Oddin. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.