See below for this month’s Waterhouse VC newsletter. The strategy specialises in global publicly listed and private businesses related to wagering and gaming.

Since inception in August 2019, Waterhouse VC has achieved a total return of 2,111% (assuming the reinvestment of all distributions) as at 31 March 2022. See our long-term performance table at the end of this newsletter.

A long European tale

Long before any industries were well-regulated, wagering flourished and was even documented in religious texts. Dice and other gaming pieces have been found in Egyptian tombs dating back to 2000 BC.

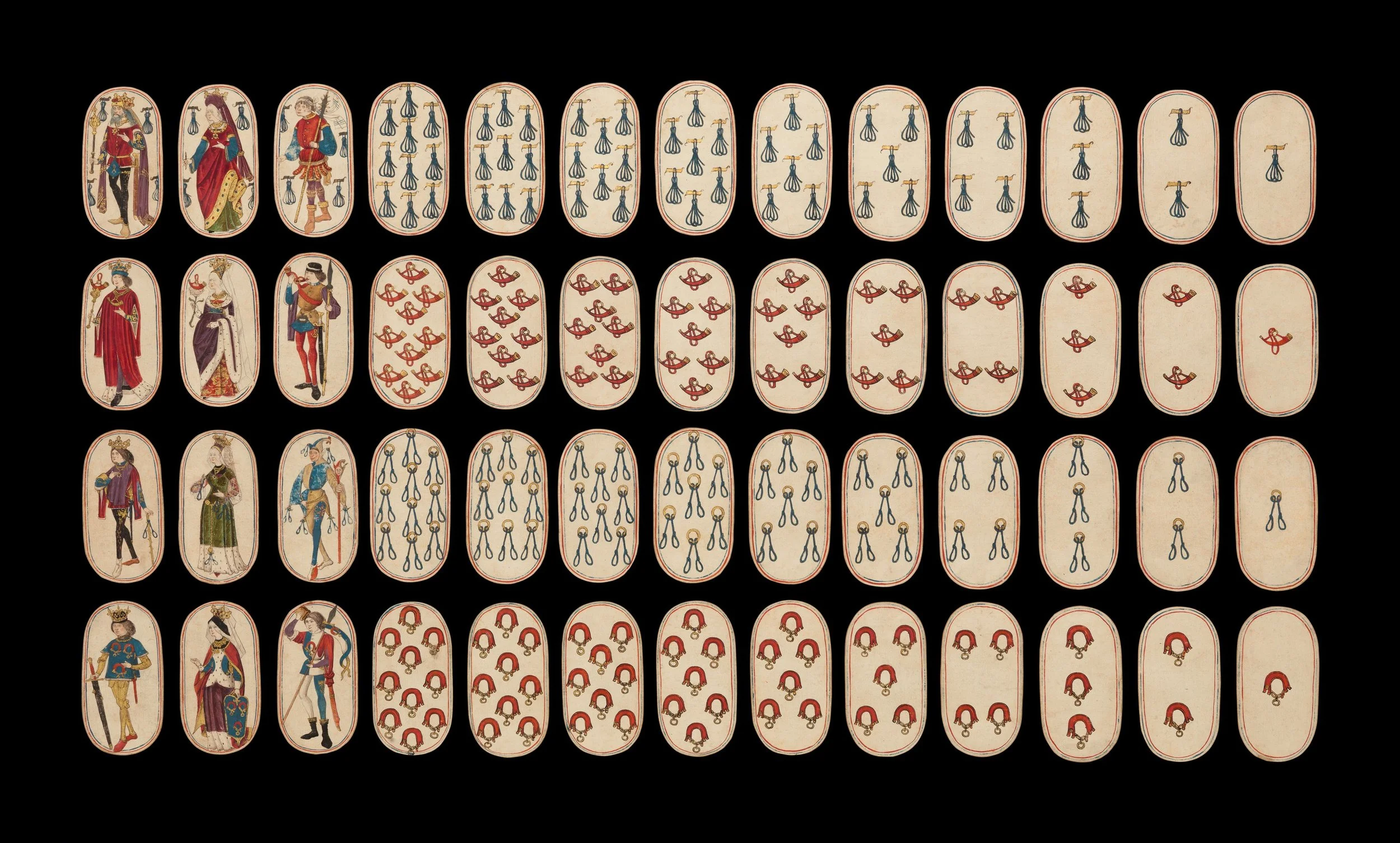

The oldest known full deck of playing cards, circa 1470-1480. Source: The Metropolitan Museum of Art

Structured, regulated casino wagering began in Europe in the 17th century, with sports betting following in the late 18th century. As a result, the world’s most mature wagering markets and operators are in the UK and Northern Europe… Ladbrokes, William Hill, Betsson, to name a few. British and European operators in regulated markets are undoubtedly mature. They generally have polar opposite key metrics to US sportsbooks, with relatively low CPAs and advertising spend, and steady market share.

US for growth, Europe for yield

Investors typically buy European wagering operators with the intention of generating a return through both dividend yield and some capital growth. They are more traditional ‘value’ businesses, a far cry from cash-hungry US operators such as DraftKings (valued at 5.1x revenue and not expected to be profitable for at least two years). When the US opened up, seasoned European operators like Flutter were able to move quickly and deploy both their technology and their digital expertise to win market share faster than US land-based operators.

Whilst our focus is set firmly on the US growth opportunity, we endeavour to hold investments with both near term weighted and future weighted cash flow profiles. More generally, we invest in high quality global businesses that exhibit: high return on equity, attractive annual revenue and earnings growth, and low financial leverage. European operators, such as 888 Holdings (888), with some US exposure, offer strong free cash flow and dividend yield without sacrificing the US growth opportunity.

When considering the current inflationary environment and economic uncertainty caused by the ongoing conflict in the Ukraine, high P/E businesses face a particularly strong risk of rerating as investors look to invest their money in lower risk assets. This macroeconomic backdrop is supportive of our positions that generate strong free cash flows.

Lucky 888

888 is an £800m scale operator with leadership positions across multiple markets: market share of 4% in the UK, 4.2% in Italy and 7% in Spain. These markets have grown strongly at a CAGR of 13%, 17% and 22% respectively in the period between 2015 and 2020. In 2021, 888 generated 13% of its revenue from operations in the Americas (2% of revenue is from the United States) and the company was recently awarded a sports betting and iGaming operator licence in Ontario. All of 888’s revenue is currently generated online.

888’s 2021 revenue mix by geography and product. Source: 888 Holdings Annual Report and Accounts 2021

Picking up the William Hill pieces

Founded in 1934, William Hill is a leading iconic brand in the UK for betting and gaming. In September last year, 888 announced a £2.2bn acquisition of William Hill International (WHI), which constitutes William Hill’s non-US assets. We already had deep knowledge of these assets since my time as CEO of William Hill Australia, and believe they are resilient stalwarts in their local markets.

For example, WHI operates over 1400 retail betting shops in the UK, generating £499m in revenue and £96m in EBITDA in 2021. Post acquisition, the combined group will have an omni-channel opportunity to leverage the UK retail footprint to improve experience and drive First Time Deposits (FTDs). 888’s proposed acquisition of these assets piqued our interest in the business and the potential strategic fit with WHI, ultimately leading to our investment in March.

888 and WHI - a powerful combination. Source: 888 Holdings Acquisition of William Hill International

On a combined basis, 888 and WHI hold top 10 leadership positions in multiple online gambling markets across Europe and Canada. When investing in gaming and wagering operators, we have a strong preference for investing in operators like 888 that demonstrate significant and resilient market share.

888 and WHI’s established and enhanced combined presence in attractive and growing online markets. Source: 888 Holdings Equity Placing

888 and WHI’s complementary geographic and product profiles. Source: 888 Holdings Equity Placing

African expansion

On 29 March, 888 announced that it is launching a joint venture in regulated markets in Africa. Pursuing a joint venture strategy allows 888 to invest in exciting new markets without distracting focus from their core business. We are excited by the African growth story.

Growth at a very reasonable price

888 has a solid historic track record of financial performance, with consistent cash flow generation. The company currently has no debt and ~£130m of net cash on its balance sheet (around 15% of its market capitalisation). In FY21, 888 generated £79m of free cash flow. The company trades at just 4.5x 2021 EV/EBITDA, which is the lowest of its publicly listed peers. 888 has a dividend payout policy of 50% of net income. At its current valuation, this conservative payout policy results in an expected dividend yield of ~5%, generating a healthy income stream to investors.

888 had initially planned to fund the WHI acquisition with £2.1bn of debt financing and a £500m equity raise. We believe that the deal could act as a trigger for a significant rerating of 888’s share price. The acquisition offers 50%+ EPS accretion and significant pre-tax cost synergies of circa £100m per year by 2025, along with potential revenue upside.

On the 7th of April, 888 announced a £250m reduction in consideration payable for the acquisition (enterprise value reduced from £2.2bn to £1.95-2.05bn; equity value reduced from £835m to £585m) due to changes in the macro-economic and regulatory environment since the announcement of the acquisition. The new acquisition terms result in a far less dilutive equity raise of c.19% of issued share capital and represent an attractive acquisition multiple of approximately 7.5x normalised EBITDA, and 5.7x on a post-synergy basis.

2020 revenue and EBITDA bridge from 888 to the combined 888 and WHI. Source: 888 Holdings Acquisition of William Hill International

We look forward to the completion of the acquisition and the continued success of a combined 888 and WHI.

Media

In January, iGaming Business published “Selling the Shovels for the US Gold Rush”, a longer form piece about Waterhouse VC. The article covers our views on Flutter, affiliate marketing, and the changing face of betting (including discussion of Voxbet) - “If you can find a great product that’s innovative and important to the sportsbook and casino operators, this is where there will be significantly higher returns”.

Please note the above information in relation to DraftKings, Flutter, Betsson and 888 Holdings is based on publicly available information in relation to the company and should not be considered nor construed as financial product advice. Waterhouse VC has a position in Flutter and 888 Holdings. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.