See below for this month’s Waterhouse VC newsletter. We specialise in global publicly listed and private businesses related to wagering and gaming.

Since inception in August 2019, Waterhouse VC has achieved a gross total return of 1,837% as at 31 December 2022, assuming the reinvestment of all distributions.

Crypto wagering

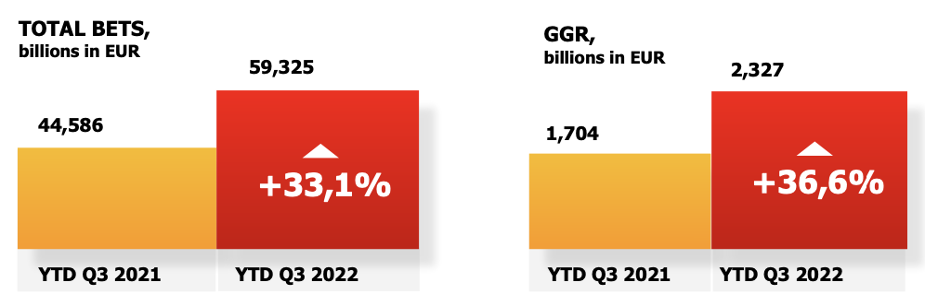

In May, we discussed the significant opportunity in crypto wagering, which is currently growing gross gaming revenue (GGR) at 36.6% per annum (Softswiss). Online crypto operators, such as Stake.com and Sportsbet.io, have a similar user experience to online fiat operators, and are already recording extraordinary turnover. White label platform solutions for crypto operators are leveraged to the growth of crypto wagering as a whole, rather than being exposed to the operational and regulatory risk of a single crypto wagering business.

Global crypto wagering data for total bets and GGR. Source: Softswiss.

Existing wagering platforms

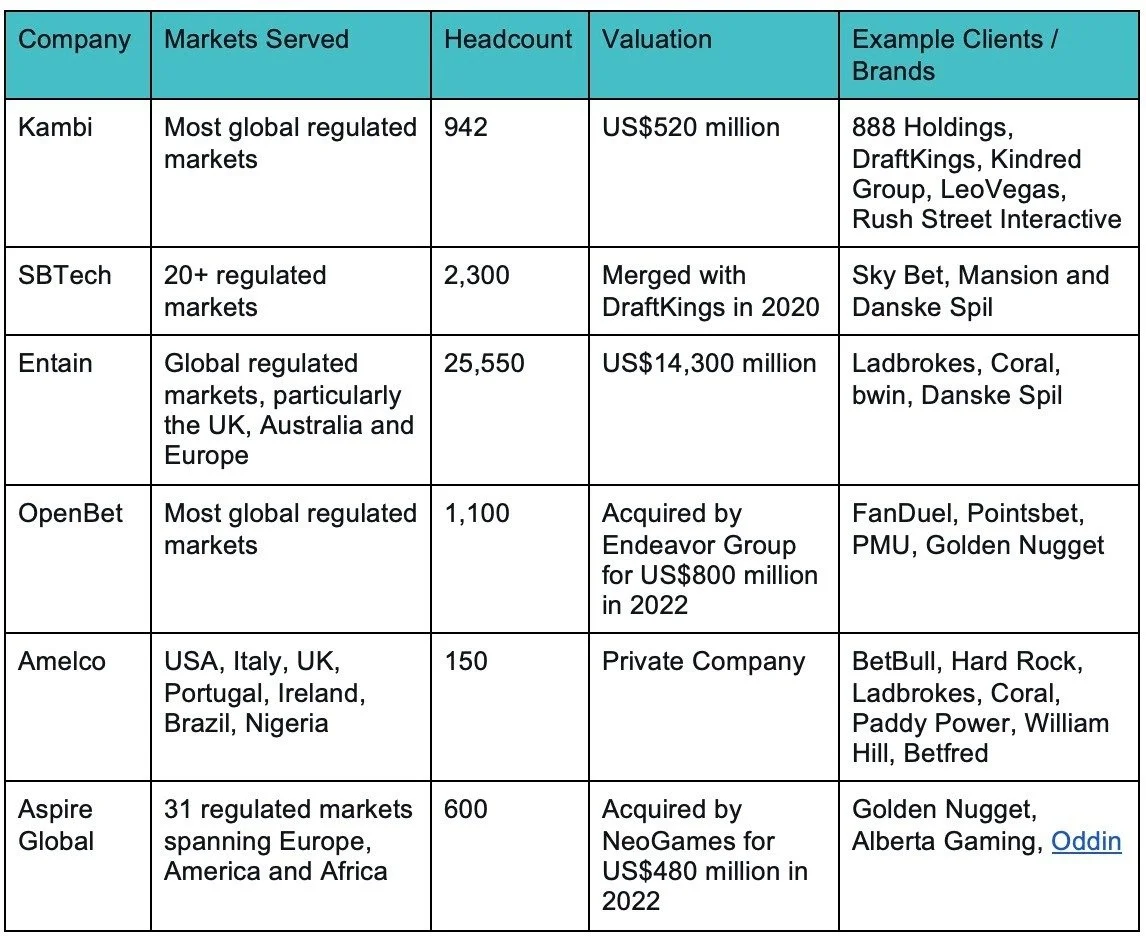

Many fiat operators rely on white label sportsbook and iGaming platform solutions, such as Kambi, OpenBet and SBTech.

A selection of white label sportsbook and iGaming platforms built for fiat operators. Source: Waterhouse VC.

However, our research concludes that many existing platform solutions have been built without all core internal needs across marketing, trading, operations, customer service and compliance. Some do not have customisation and changes typically require further costly development. The customer profiling and risk configurations result in suboptimal customer experiences for highly profitable customers and deeper losses to negative value customers. Some platforms are unable to keep up with customer demands or provide segmented customer experience. All of the above existing platforms were founded over 12 years ago and some continue to rely on legacy technology. Technical debt compounds over time and is a key challenge for platforms, as well as technology companies more broadly.

Future of wagering platforms

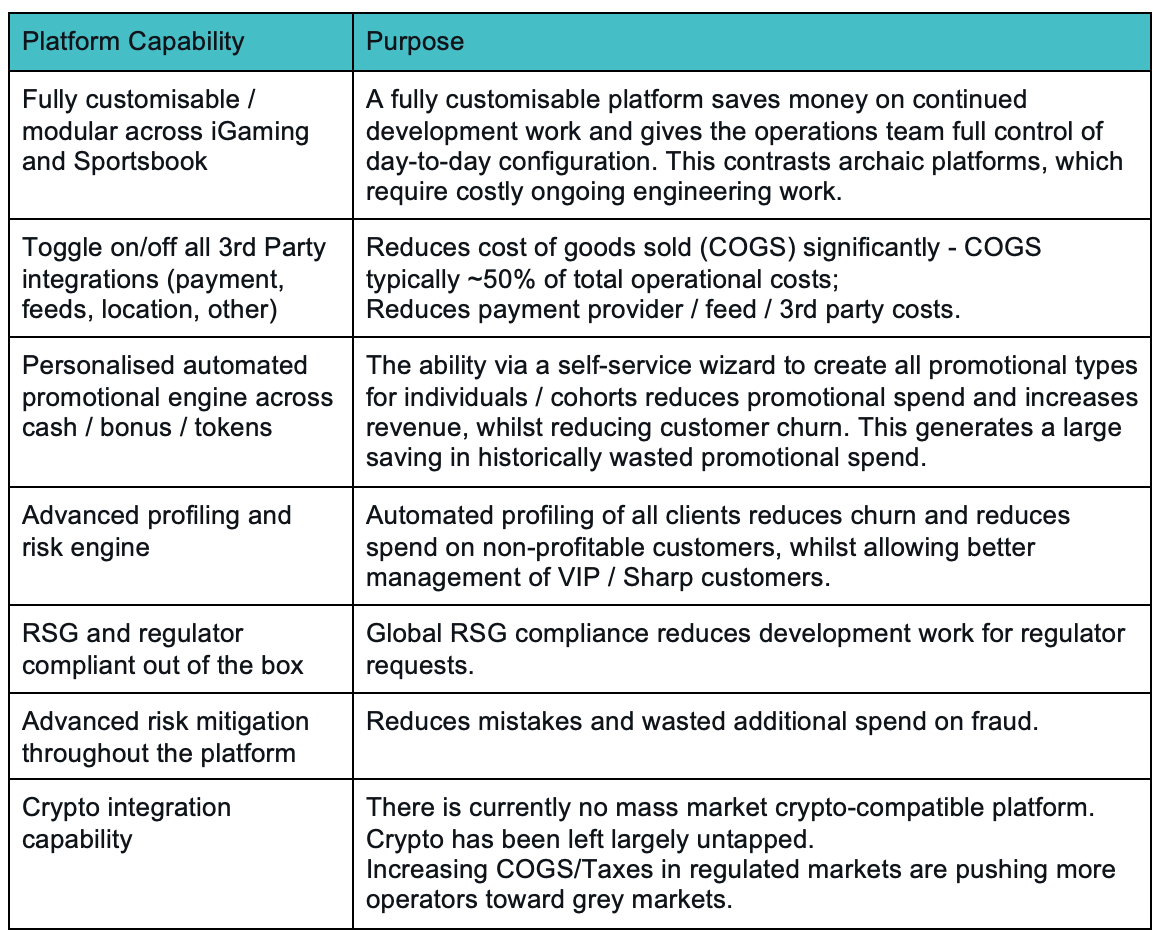

There is a significant opportunity to develop a new breed of wagering platforms that combine racing, sports and gaming with both crypto and fiat payment capabilities. Key core platform capabilities are summarised below.

Key points of difference for the next generation of wagering platforms. Source: Waterhouse VC.

We are seeing opportunities emerging to invest in the next generation of wagering platforms, leveraging new technology and embedding modern third party integrations. These platforms will integrate crypto at the technology layer rather than as an afterthought. Considering the continued growth of crypto wagering globally as well as all online wagering in the US, we are very excited by the possible opportunities. A key element of our approach will be to identify management teams that have significant experience in the direct build and operation of successful platforms in competitive markets.

Media

On 7-9th February, I will be speaking at ICE London 2023, a gaming and wagering conference with over 35,000 attendees. ICE London showcases the industry’s latest innovations, technology solutions, regulatory updates and expert insights. Register for ICE London 2023 here.

We recently contributed to some wagering industry predictions for the year ahead. We were joined by Jonathan Power, Managing Director of Voxbet, a portfolio company. See the predictions here.

For wholesale investors interested in following wagering and gaming industry news and trends, please follow our updates on Twitter (@waterhousevc) or through our website at WaterhouseVC.com.

DISCLAIMER AND IMPORTANT NOTES

Please note the above information in relation to Voxbet, Aspire Global, Kambi, SB Tech, Entain, Endeavor Group Holdings, Stake.com, Sportsbet.io and Amelco is based on publicly available information in relation to the company and should not be considered nor construed as financial product advice. Waterhouse VC has a position in Voxbet. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

General Information Only

This material is for general information only and is not an offer for the purchase or sale of any financial product or service. The material has been prepared for investors who qualify as wholesale clients under sections 761G of the Corporations Act or to any other person who is not required to be given a regulated disclosure document under the Corporations Act. The material is not intended to provide you with financial or tax advice and does not take into account your objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by Sandford Capital, Waterhouse VC or any other person. To the maximum extent possible, Sandford Capital, Waterhouse VC or any other person do not accept any liability for any statement in this material.

Financial Regulatory Oversight and Administration

Waterhouse VC is an Australian Unit Trust denominated in AUD and available to wholesale institutional investors worldwide with a minimum of AUD 1,000,000 or USD / EUR / GBP / JPY / CHF equivalent. This material has been prepared by Waterhouse VC Pty Ltd (ABN 48 635 494 861) (‘Waterhouse VC’, ‘Trustee’, ‘us’ or ‘we’) as the Trustee of the Waterhouse VC Fund (the ‘Fund’). The Trustee is a corporate authorised representative (CAR 1296688) of Sandford Capital Pty Limited (ABN 82 600 590 887) (AFSL 461981) (Sandford Capital) and appoints Sandford Capital as its AFS licensed intermediary under s911A(2)(b) of the Corporations Act 2001 (Cth) to arrange for the offer to issue, vary or dispose of units in the Fund.

Performance

Past performance of Waterhouse VC is not a reliable indicator of future performance. Waterhouse VC Pty Ltd does not guarantee the performance of any strategy or the return of an investor’s capital or any specific rate of return. No allowance has been made for taxation, where applicable. We encourage you to think of investing as a long-term pursuit.

Copyright

Copyright © Waterhouse VC Pty Ltd ACN 635 494 861. No part of this message, or its content, may be reproduced in any form without the prior consent of Waterhouse VC.

Governing Law

These Terms and Conditions of use are governed by and are to be construed in accordance with the laws of New South Wales. By accepting these Terms and Conditions of use, you agree to the non-exclusive jurisdiction of the courts of New South Wales, Australia in respect of any proceedings concerning these Terms and Conditions of use.