See below for this month’s Waterhouse VC newsletter. We specialise in global publicly listed and private businesses related to wagering and gaming.

Since inception in August 2019, Waterhouse VC has achieved a gross total return of 2,510% as at 30 November 2023, assuming the reinvestment of all distributions.

Mr Monopoly

$10 coffees? It’s too much but if you are the only cafe in town, you have pricing power - and people love coffee.

So it is in regulated wagering markets, where monopolies commonly exist. They have significant advantages in that they offer exclusive products, have widely trusted brands and a strong relationship with government and industry. However, due to a lack of competition and a limited product offering, it can sometimes lead to a suboptimal outcome for consumers.

Examples of some monopolies are provided below.

Happy Valley

Established in 1884, the HKJC has a rich history rooted in horse racing. The club's inaugural races were held at Happy Valley. The club actively contributes to charitable causes, becoming a hallmark of its identity and position in Hong Kong’s economic landscape. In 1959, regulatory changes through the Betting Duty Ordinance expanded the HKJC's scope to allow off-course betting.

The HKJC incurs a 50% duty on its gross margin from football, whilst the duty on racing reaches up to 75%. In the 2022/23 fiscal year, the HKJC gave back US$4.6 billion to the community. This comprised US$3.7 billion contributed to the government in the form of duty, profits tax, and Lotteries Fund contributions, along with US$0.9 billion in donations to charities.

B2Bs and monopolies

At Waterhouse VC, we focus on B2B suppliers that provide a critical or innovative service to wagering operators. Nearly every wagering operator requires odds pricing, trading and risk management, player account management (including KYC/AML compliance), customer engagement and marketing services.

Similarly to other operators, monopolies benefit significantly from technological advancements in the industry, closely monitoring trends in product offering, and integrating with innovative B2B products. There is a huge opportunity for B2B suppliers to integrate with monopolies. For example, Voxbet (one of our portfolio companies - see more here) has had PMU as a client for 7 years.

If monopolies maintain a modern technology stack and are permitted to develop a full product offering, it could give them the technological capability, product offering and great customer experience required to expand their already well-known brand outside of their domestic jurisdiction to effectively operate in more competitive regulated markets. Geographical expansion would also allow them to increase their tax contributions and charitable activities in their home country.

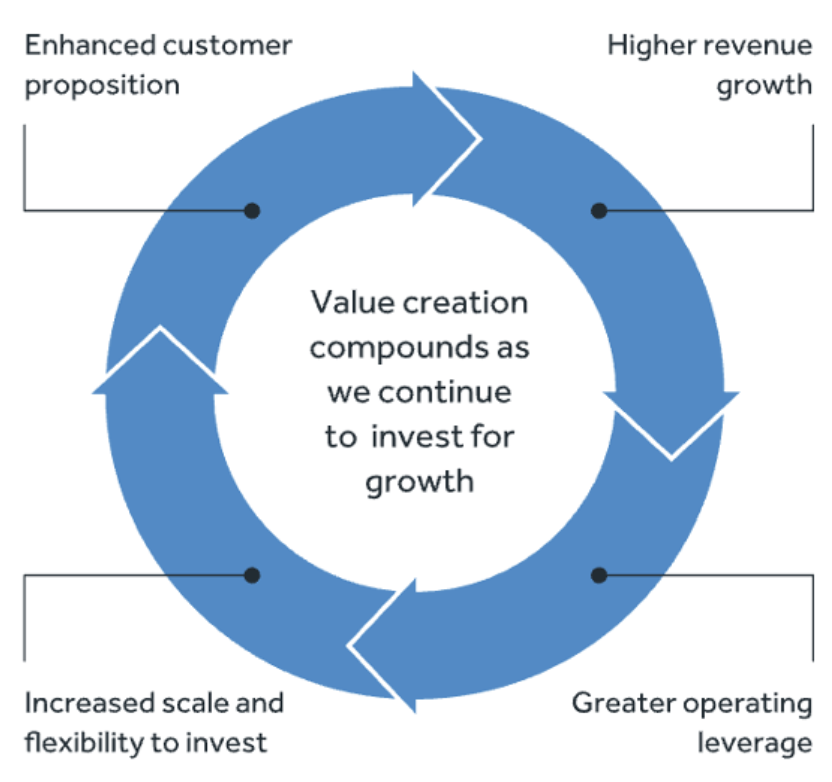

By applying their domestic experience, product offering and technology stack to other markets, monopolies could echo Flutter’s global strategy. Flutter developed its expertise in the UK through Paddy Power before expanding to Australia (Sportsbet), the US (FanDuel) and globally (‘local heroes’ including Sisal and MaxBet). The company has cultivated market-leading global wagering businesses by leveraging its expertise and resources in product development, customer insights and data analytics. They have effectively taken advantage of operational leverage, leading to a ‘flywheel’ effect (shown below).

Flutter’s flywheel. Source: Flutter Entertainment Plc

Bleeding out to unregulated operators

On the 5th of September, following its annual general meeting, the HKJC specifically highlighted the leakage that has been occurring as wagering volumes shift towards unregulated operators.

“In the digital age, the Club faces significant competition from illegal bookmakers who pay no tax, and from overseas sports betting bookmakers who operate under very low tax regimes. Illegal and overseas betting operators are already earning profits in excess of HK$15 billion a year from Hong Kong customers. If betting duty rates increase the Club would face a significant decrease in income and would be less price competitive. As a result the Club would be unable to invest for its future.” - The Hong Kong Jockey Club

Taxation revenue leakage is occurring throughout regulated wagering markets. For example, in the US, it is estimated that unregulated operators attract annual bets totaling US$510.9 billion from Americans. This leads to a substantial loss of US$44.2 billion in gaming revenue for the regulated betting industry and a loss of US$13.3 billion in tax revenue for state governments ("Sizing the Illegal and Unregulated Gaming Markets in the United States" - American Gaming Association, 2022)

Filling gaps in product to grow monopolies

Relying solely on their monopoly position is not an optimal strategy for monopolies, particularly in the context of increasingly accessible unregulated wagering. Unregulated wagering will compel monopolies to engage in at least some level of competition and they must deliver an attractive product offering and customer experience. As regulated monopolies face continued pressure from unregulated operators, they must consistently innovate to retain and attract customers.

In markets where some wagering products are banned (such as iGaming and sports outside of football in Hong Kong; or iGaming and in-play wagering in Australia), introducing a monopoly licence covering product gaps could significantly reduce leakage to unregulated operators whilst increasing taxation and charitable donations. This would also protect bettors as unregulated markets generally provide lower levels of consumer protection.

If a monopoly operator is unable to provide a comprehensive range of wagering products within their domestic jurisdiction (including pre-match sports, in-play sports, racing, iGaming, lottery, and bingo), unregulated operators seize the opportunity to attract customers and further enhance their own ‘flywheel’. In this scenario, monopolies are not maximising their potential domestically - let alone internationally.

Media

I recently spoke on the AKBets podcast about my family history, making business decisions, the future of wagering and Waterhouse VC's investment strategy (listen here).

For wholesale investors interested in following wagering and gaming industry news and trends, please follow our updates on Twitter (@waterhousevc) or through our website at WaterhouseVC.com.

All the best,

Tom

DISCLAIMER AND IMPORTANT NOTES

Please note the above information in relation to Hong Kong Jockey Club, Voxbet, OPAP, Française des Jeux, Norsk Tipping, PMU and Flutter Entertainment Plc is based on publicly available information in relation to the company and should not be considered nor construed as financial product advice. The Fund currently has a position in Flutter Entertainment Plc and Voxbet. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

General Information Only

This material is for general information only and is not an offer for the purchase or sale of any financial product or service. The material has been prepared for investors who qualify as wholesale clients under sections 761G of the Corporations Act or to any other person who is not required to be given a regulated disclosure document under the Corporations Act. The material is not intended to provide you with financial or tax advice and does not take into account your objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by Sandford Capital, Waterhouse VC or any other person. To the maximum extent possible, Sandford Capital, Waterhouse VC or any other person do not accept any liability for any statement in this material.

Financial Regulatory Oversight and Administration

Waterhouse VC is an Australian Unit Trust denominated in AUD and available to wholesale institutional investors worldwide with a minimum of AUD 1,000,000 or USD / EUR / GBP / JPY / CHF equivalent. This material has been prepared by Waterhouse VC Pty Ltd (ABN 48 635 494 861) (‘Waterhouse VC’, ‘Trustee’, ‘us’ or ‘we’) as the Trustee of the Waterhouse VC Fund (the ‘Fund’). The Trustee is a corporate authorised representative (CAR 1296688) of Sandford Capital Pty Limited (ABN 82 600 590 887) (AFSL 461981) (Sandford Capital) and appoints Sandford Capital as its AFS licensed intermediary under s911A(2)(b) of the Corporations Act 2001 (Cth) to arrange for the offer to issue, vary or dispose of units in the Fund.

Performance

Past performance of Waterhouse VC is not a reliable indicator of future performance. Waterhouse VC Pty Ltd does not guarantee the performance of any strategy or the return of an investor’s capital or any specific rate of return. No allowance has been made for taxation, where applicable. We encourage you to think of investing as a long-term pursuit.

Copyright

Copyright © Waterhouse VC Pty Ltd ACN 635 494 861. No part of this message, or its content, may be reproduced in any form without the prior consent of Waterhouse VC.

Governing Law

These Terms and Conditions of use are governed by and are to be construed in accordance with the laws of New South Wales. By accepting these Terms and Conditions of use, you agree to the non-exclusive jurisdiction of the courts of New South Wales, Australia in respect of any proceedings concerning these Terms and Conditions of use.